I am not a EURUSD bull and find it hard to make a case for not shorting the pair when it sets up. Some concerns that continue to weigh on the euro include who down the road will replace Angela Merkel in Germany, Brexit outcome, Italian budget, and moderate growth and inflation in the euro zone with the first rate hike not before autumn 2019 at the earliest.

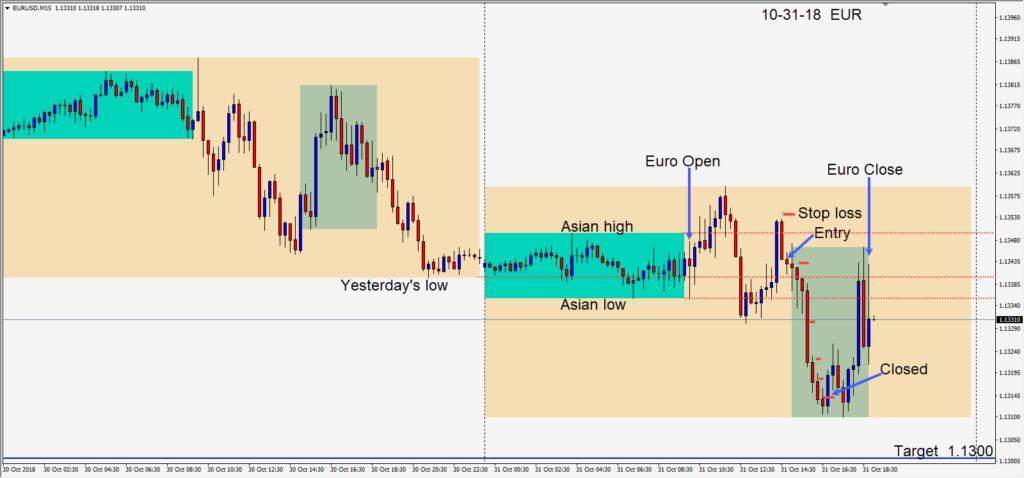

Just before the U.S. session got underway today, the pair made a second lower high for the session and an entry short was taken risking 10 pips for a potential 43 pips to the 1.1300 figure. This seems to be a level where buyers are entering but I’m not expecting it to hold for long. The idea today was to enter with a small stop loss and keep it tight as price moved down to test the 1.1300 level and locking in profit along the way.

Tomorrow is a holiday for some European countries so trading will be lighter.

Friday is NFP in the U.S. and I will be taking it off.

Good luck with your trading!