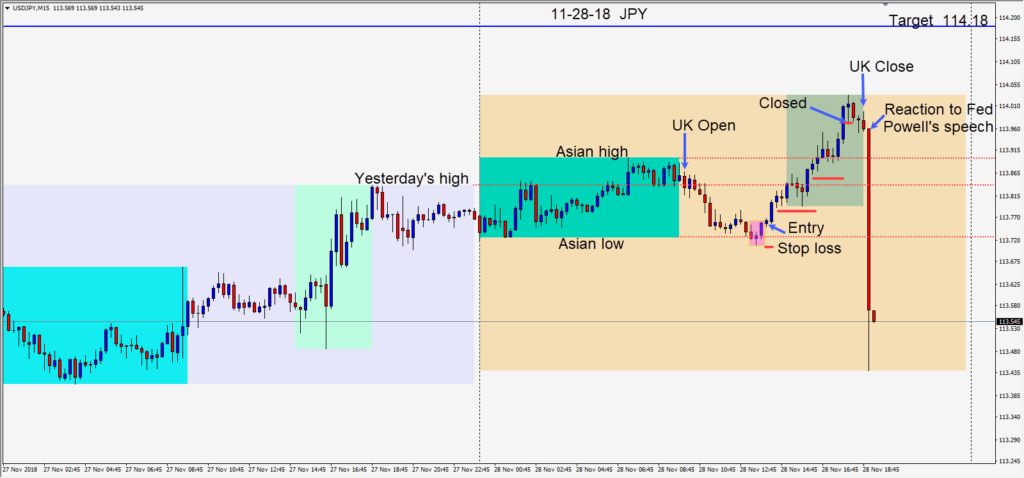

Today as the USDJPY moved down it found buyers at its Asian session low and a reversal setup gave us an entry risking 6 pips for a potential 42 pips to our daily target at 114.18. Price moved up very little in advance of the U.S. Open and we moved our stop loss up to protect the trade from going negative if the pending U.S. economic GDP release reaction pushed price lower. The pair continued to move higher with the moderately stronger USD today. It paused at its Asian session high, retested the level then moved higher. We continued to move our profit stop higher and the trade was closed as price pulled back to our profit stop.

This trade was very routine and far from exciting. The lesson for anyone who doesn’t know it already…is that a trader should always lock in profit as the market can reverse in a blink and you can quickly move from a positive position to a negative one. What would be worse is to trade without a stop loss.

When Fed Chair Powell spoke today the USD abruptly turned negative. His comment, “While FOMC participants’ projections are based on our best assessments of the outlook, there is no preset policy path. We will be paying very close attention to what incoming economic and financial data are telling us.” did not sit well with USD bulls. The USDJPY dropped over 50 pips and the AUDUSD jumped up 90 pips.

Always be aware of the potential effect that a central banker’s comments can have on a country’s currency.

Good luck with your trading!