On Monday, which was a North American bank holiday the EURUSD finally broke the 1.1300 level and quite decidedly as it moved down to 1.1215.

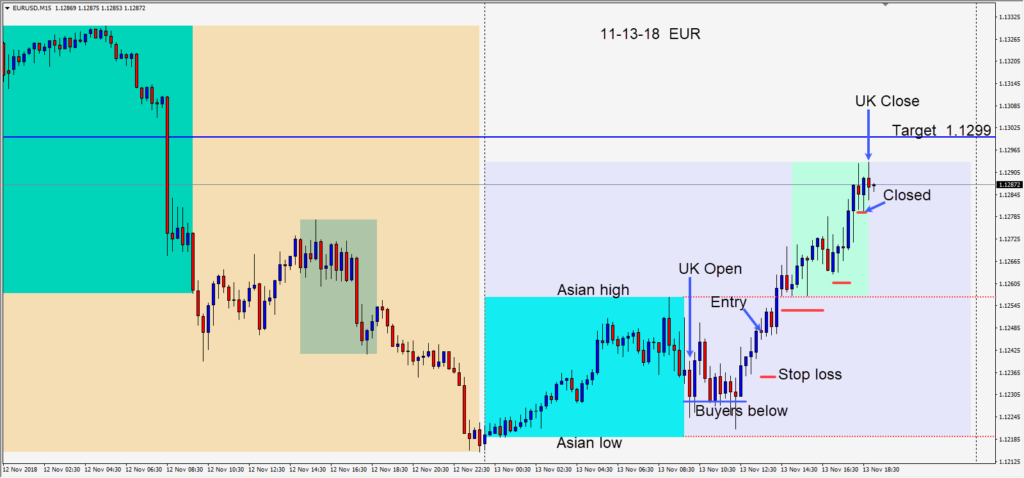

On Tuesday, it would be normal for it to retest the 1.1300 level and we would discover if buyers or sellers would prevail. Having found support around 1.1228 price began to move upward. A long was taken risking 13 pips for a potential 51 pips to our daily target at 1.1299. We removed the risk from the trade in advance of the U.S. open. After a very bearish candle closed on its low, we moved our profit stop up a little further. Price continued upward and after another bearish candle with a long upper wick formed, we tightened our profit stop and our trade was subsequently closed.

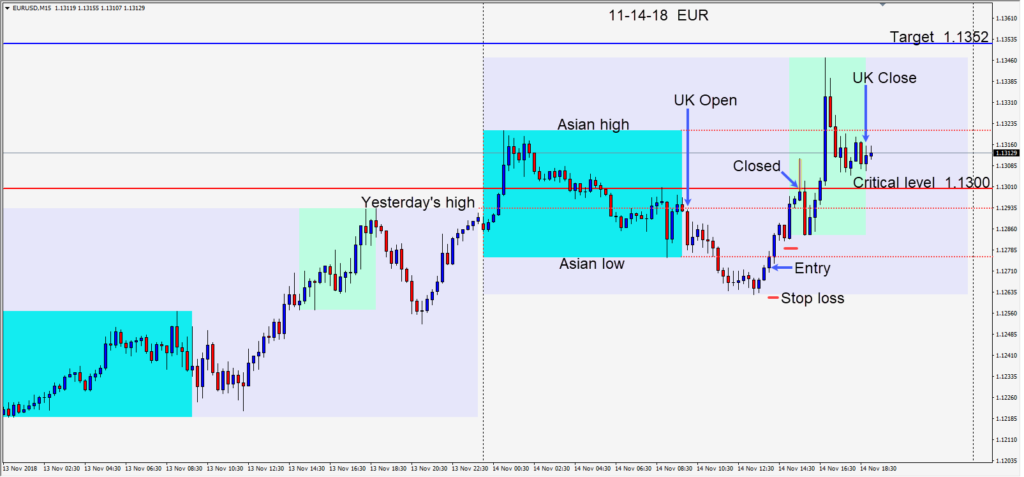

On Wednesday, after initially moving down to begin the U.K session, price found support around 1.1265 and began to move up. A long was taken risking 10 pips for a potential 80 pips to our daily target at 1.1352. Price moved higher and we protected ourselves by moving to a profit stop in advance of the U.S. open. Price continued higher but was unable to sustain above 1.1300 and we closed the trade as it reversed.

It would appear that both the EURUSD and GBPUSD are moving higher on positive Brexit headlines, but until there is a deal, these moves tend to be fleeting. The GBPUSD is extremely susceptible and volatile.

We are also seeing money flows to the JPY as risk-off sentiment is evident by looking at equity markets, gold, 10 year yields and USD weakness.

Good luck with your trading!