Equity markets continued to sell off and the U.S. 10 year yield continued lower today as did the USD. It was no surprise that gold moved higher and money flows were moving to the yen.

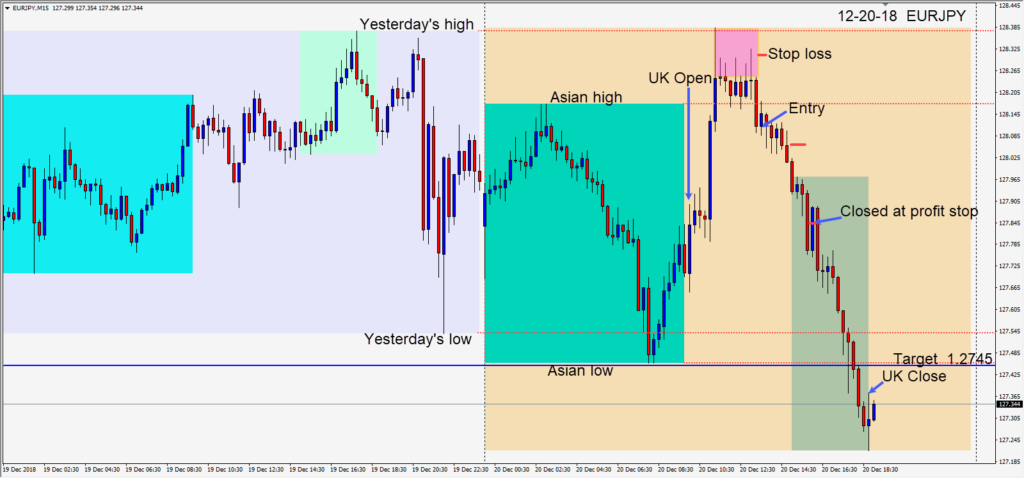

The EURJPY fell during the Asian session then retraced upward where it ran into sellers around 128.25. As it broke to the downside and closed back beneath its Asian session highs a short was taken risking 22 pips for a potential 66 pips to our daily target at 127.45.

In trading we define our risk by setting a stop loss and accepting that if the trade moves against us, and our stop loss is triggered, that is where we want to be out of the trade. By defining our risk we accept the possibility that if the market moves against us, how much of a loss we are comfortable taking. The purpose of a stop loss is to define our risk and prevent our account from potentially suffering catastrophic damage.

As price moves in our desired direction, we can take the risk out of the trade by moving our stop loss to a profitable position. Each time we move our profit stop from that point forward, we are locking in more profit. If the trade reverses and closes, then we have a profitable winning trade. From that point on whatever the market does…it does without us.

Today with the EURJPY price moved down and we took the risk out of the trade by moving our stop loss to a positive position in advance of the U.S. open. Price continued downward and we locked in more profit…accepting that if price reversed we would still have a positive winning trade. Price did reverse for one candle and closed our trade before descending to and through our daily target.

We never know in trading where the next candle will close. We have control in defining our risk when we enter a trade, and removing risk from the trade as we lock in profit. Acceptance of this concept can be useful for your trading success. It also reduces a lot of potential stress.

Good luck with your trading!