It’s nice to see the USD moving higher as the week began.

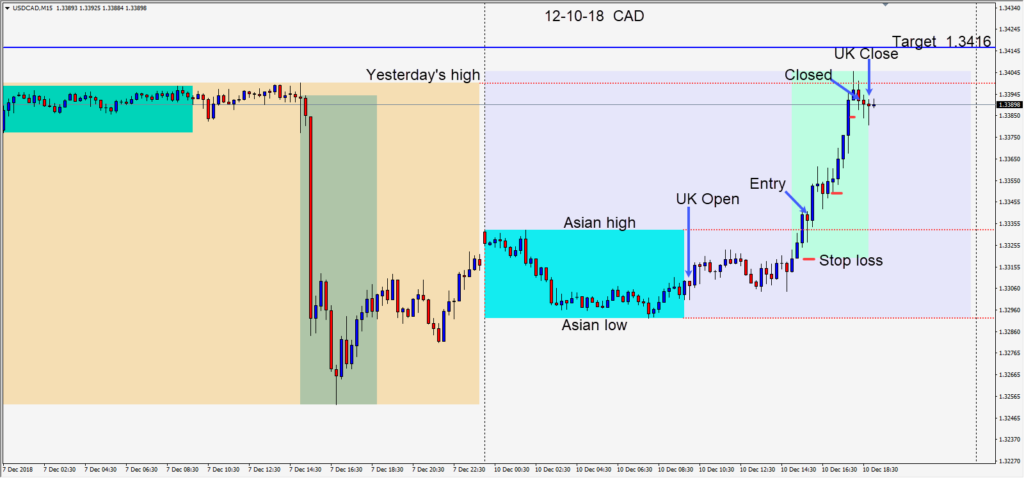

On Monday with a very strong USD and crude oil WTI moving lower a long was taken on the USDCAD risking 22 pips for a potential 77 pips to our daily target at 1.3416. Price moved up quickly to Friday’s high and but was unable to close above and left a long upper wick. Price again failed to close higher, made a lower high and we closed the trade with 30 minutes left in the UK session.

On Tuesday, the USD was moderately stronger and after an initial move higher in the first half of the U.K. session, the EURUSD began to fade. Not wanting to enter right away as there was U.S. economic news pending, we waited as price pulled back through its Asian session high. We entered short risking 19 pips for a potential 48 pips to our daily target at 1.1320.

Price moved rapidly lower and as it touched 1.1320 our trade was closed.

The GBPUSD remains very active, but the stop losses have been too large for my comfort zone so far this week. Rumours that Teresa May’s days as the Prime Minister may be coming to an end, could cause the GBPUSD to experience a short term bounce. The pair has been finding buyers at 1.2500 this week. The negativity toward a positive Brexit outcome and where Britain will go from here if P.M. May is replaced, may cause a further move down. Markets tend to be wary of uncertainty. Be very cautious trading this pair, but my preferred direction is short when the setup presents itself.

Good luck with your trading!