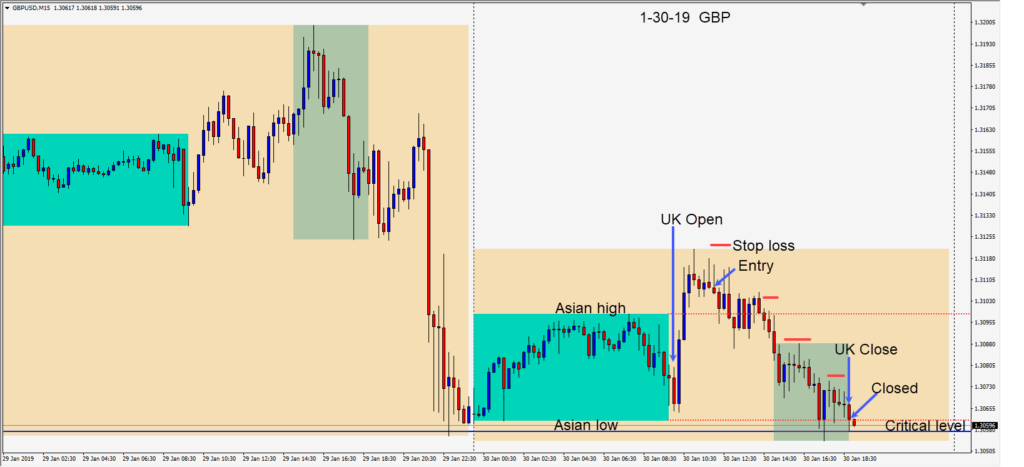

Recent amendments have done little, time is running out and unless the U.K. can take active measures to prevent a “no deal” Brexit it will leave the EU without a deal on March 29th. Last week’s optimism and rise in the GBP faded today.

As the U.K. session got underway the GBPUSD climbed above its Asian high and stalled. Sellers entered and began pushing price down as evidenced by the long upper wicks and lower highs forming. A short was taken and the critical level today to get through was around 1.3060. If this level gives way, price may retest it but if sellers enter again, I expect 1.3000 to be targeted and a potential move down to test the 1.2900 level.

Unable to make it through the 1.3060 level by the London close, we exited the trade at the end of the session.

However, if profound progress is made regarding Brexit, buyers will enter… and a test of last week’s enthusiastic high at 1.3216 is in sight.

The markets await for any clues from Jerome Powell today regarding any clues as to the next rate hike this year. The U.S. – China trade talks resume in Washington today. Oil is rising as Venezuala’s oil supply to the market could be cut off. Non-farm employment change awaits us on Friday.

Good luck with your trading!