There are a number of conflicting signals in the markets this week – making it difficult to find high probability trade setups. The market has a lot to digest to begin 2019.. as it looks forward.

Equity markets continued higher today along with gold, oil, the U.S. 10 yr yield but the USD dropped. The Nikkei was up over 1% today, but the USDJPY set up for a short. Even the AUDJPY moved lower usually implying a risk off tone.

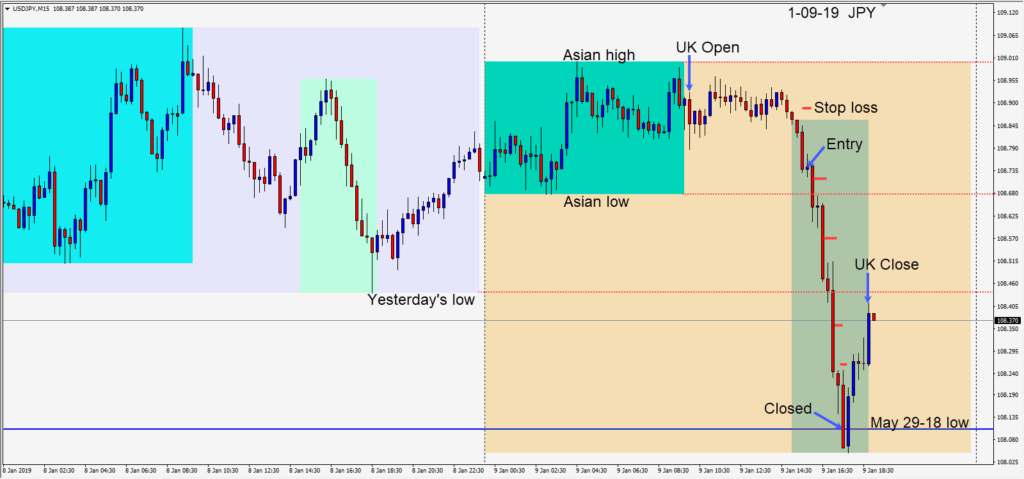

After the U.S. traders got underway, a short was taken in the USDJPY risking 15 pips for a potential 30 pips to yesterday’s low. As price began to move down, we took the risk out of the trade by moving our stop loss to plus 2 giving the trade some room to test and retest its Asian session low. As price moved lower, we locked in more profit and gave it room to retest yesterday’s low. Price continued lower and as it moved toward the 108.00 figure, we closed the trade just above at 108.10 – the low from May 29, 2018.

Even P.M. May’s Brexit defeat today in parliament didn’t sink the GBPUSD which suggests how weak the USD is today. U.S. – China trade talks are continuing and rumours are positive, but the USD is moving lower. If it all seems a little confusing…it’s because it is! Traders now awaits Jerome Powell’s comments tomorrow for further guidance.

Good luck with your trading!