The USD strengthened all week and China was on holiday celebrating the lunar New Year.

On Friday the news reported that a meeting between the presidents of the U.S. and China was unlikely to happen before the March 1st tariff deadline. Adding to that was U.S. economic advisor Larry Kudlow commenting that the two sides are still far apart in the trade negotiations. Adding to the tension is the U.S. pushing to ban Huawei, the Chinese telecom equipment maker from U.S. wireless networks, and also telling the E.U. to do the same or risk U.S. countermeasures.

In Europe soft economic numbers from Germany and the European Commission aggressively slashing it’s 2019 growth forecast for the Eurozone from 1.9% to 1.3% and Italy’s from 1.2% to 0.2% created a “risk off” sentiment for the markets.

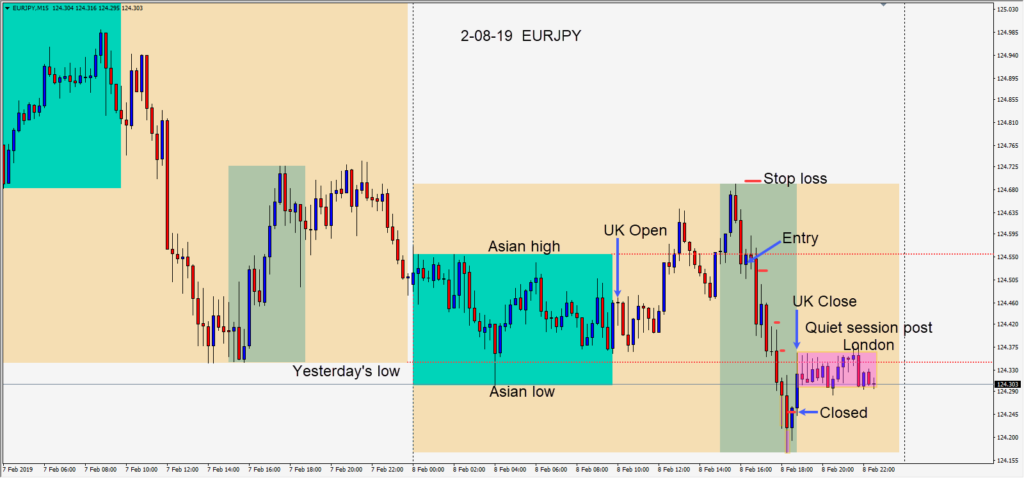

A short was taken on the EURJPY early in the U.S. session risking 18 pips for a potential 62 pips to our daily target at 123.90 – as price closed beneath its Asian high. Price moved lower to test yesterday’s low before moving further to test its Asian low. Long lower wicks began to form as buyers entered and we tightened our profit stop as the London close approached. Our profit stop was hit – well short of our intended target but for a nice trade to close a quiet week of trading.

I have highlighted an area of the chart to show how quiet the U.S. session tends to be after the London close. It’s not always the case, but frequently price tends to consolidate and move sideways, unless there is something significant pending – like Fed. Powell scheduled to speak.

In trading it’s very important to be disciplined and follow a certain set of rules each day. If you have a solid trading plan and you’re consistent in your execution, then making profits and avoiding large losses is attainable. Some weeks will be more rewarding than others, but we never trade for the sake of trading.

Good luck with your trading and enjoy your weekend!