Trading has been a little slow since Wednesday last week for me and the market is giving some mixed signals. I find it better to be patient and disciplined than to force trades and regret the outcome.

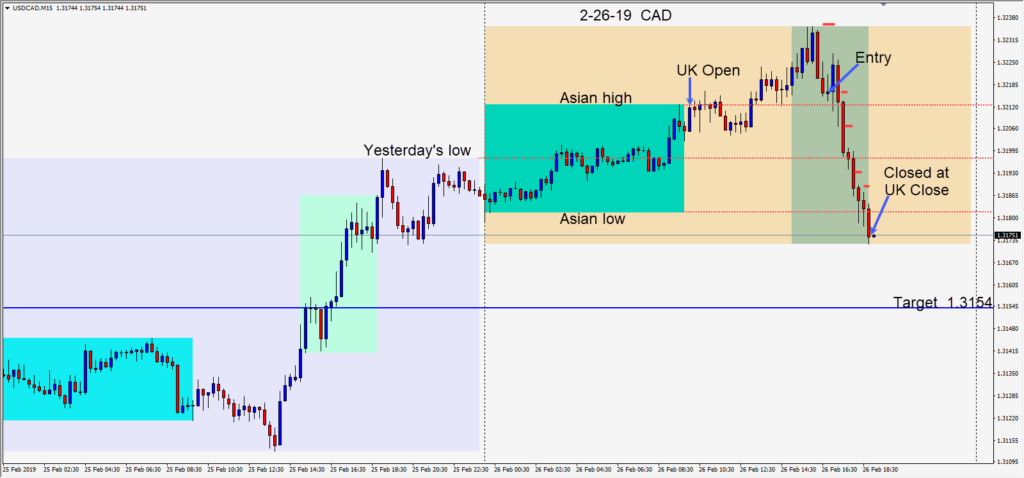

The 1.3150 – 1.3250 area is an important range for the USDCAD at the moment. Today the idea was to take advantage of the weaker USD and slightly higher WTI price.

A short was taken risking 21 pips for a potential 62 pips to our daily target at 1.3154. We had to be patient with the trade, but it eventually began to move downward through its Asian session low, and we closed it at the end of the London session.

The U.S. – China trade talks have made sufficient progress for President Trump to lift the March 1st tariff deadline. He will be meeting for the second time with North Korean President Kim Jong Un in Vietnam to discuss the denuclearization of North Korea. Britain’s Brexit plans remain unresolved, but the GBPUSD is moving higher with optimism…not substance, which means it can drop like a rock if the pessimism resurfaces and a “no deal Brexit” seems imminent.

Lots of mixed signals as the market digests the bigger picture. Be very careful selecting your trade setups.

Good luck with your trading!