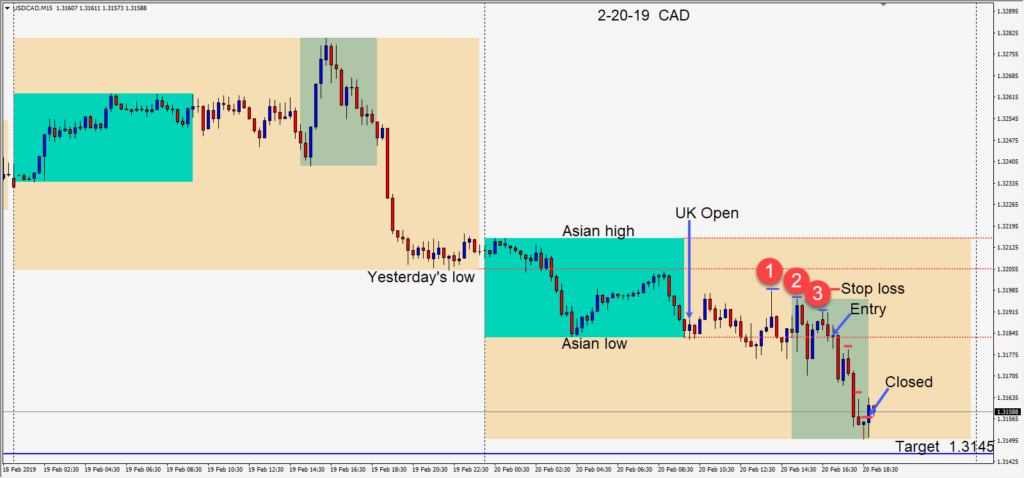

On Wednesday before the FOMC Meeting minutes, a trade was found in the USDCAD as it made a series of 3 lower highs – moving down to its Asian session low. Entering short we risked 14 pips for a potential 38 pips to our daily target at 1.3145 with 2 hours left before the London close.

Price moved down helped by WTI moving higher at the time and got very near our target price, but began to bounce before the London close – taking us out of the trade.

The reaction to the Fed. minutes was somewhat subdued and the USD closed positively for the day.

On Thursday, there were no trades for me as the market adjusted further to Fed’s outlook. Traders are now pricing in a 90% probability that the Fed will not increase rates in 2019. There is a 7% probability of a rate cut and now only a 3 percent probability of a rate hike.

On Friday ECB President Draghi will be speaking and traders will be listening carefully. Anticipate euro volatility as the market reacts to his comments – particularly if he is more dovish than the market anticipates.

I remain USD bullish, but not as bullish as last year at this time.

Good luck with your trading!