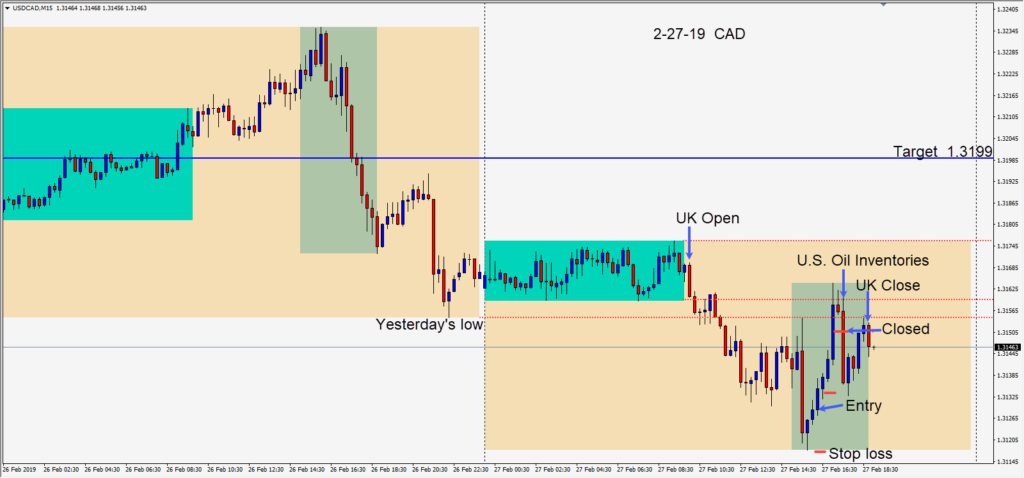

Most Wednesdays, the U.S. Crude Oil Inventories are released. If there is a surprise shortfall…like today…we are likely to see the price of WTI go up and the Canadian dollar benefit. If there is a surprise surplus, then we likely to see WTI move down and the Canadian dollar move down.

Today it looked to me like the USDCAD had found a bottom and was moving higher. A long was taken risking 12 pips for a potential 70 pips to our daily target at 1.3199. It was an aggressive entry because the inventories release was pending. Price moved higher and paused in its ascent just before the release. Allowing for some minor volatility, the profit stop was moved to halfway down the previous blue candle. The news was released and with a very large shortfall in inventories, the pair reversed… closing our trade as WTI jumped up. It’s never fun giving back pips but trading in front of news seems to do it more often than not.

Good luck with your trading!