ECB President Mario Draghi confirmed yesterday that improvement in growth and inflation is still expected in the second half of 2019 and if that doesn’t happen, then the officials are ready to take action.

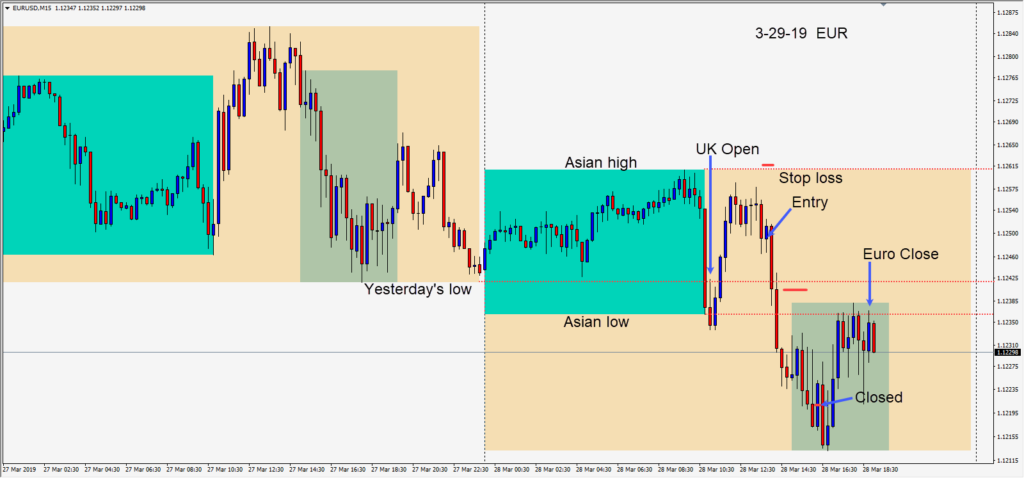

In advance of the U.K. open the EURUSD sold off, it then pulled back making a lower high and went sideways. As it broke to the downside once again, a short was taken risking 13 pips for a potential 60 pips to our daily target at 1.1188. Price began to move down quickly and closed beneath its Asian session low in advance of the U.S. open. We moved our profit stop down allowing for a retest of this level. Price continued lower as the U.S. session got underway and the first reversal candle closed the trade.

I continue to be USD bullish and Euro bearish. If the economic numbers continue to look more like they are pointing toward recession in the E.U. and not showing meaningful inflation, the EURUSD may test 1.1000 going forward.

Although the U.S. is slowing compared to last year, it is still growing and the Fed has flexibility with interest rates.

The U.K. continues to be unable to put forward an acceptable Brexit agenda. The Japanese yen continues to benefit only on risk off days, but gold has tumbled beneath $1300 once again with the rekindled USD strength this week.

Good luck with your trading!