ECB President Draghi was going to speaking today and the market was already bearish about the E.U. economic numbers. Germany barely missed going into recession and Italy is in much worse shape. Chances of hearing of an interest rate hike this year is not expected. The Eurozone is slowing more than expected and this continues to create downward pressure on the currency.

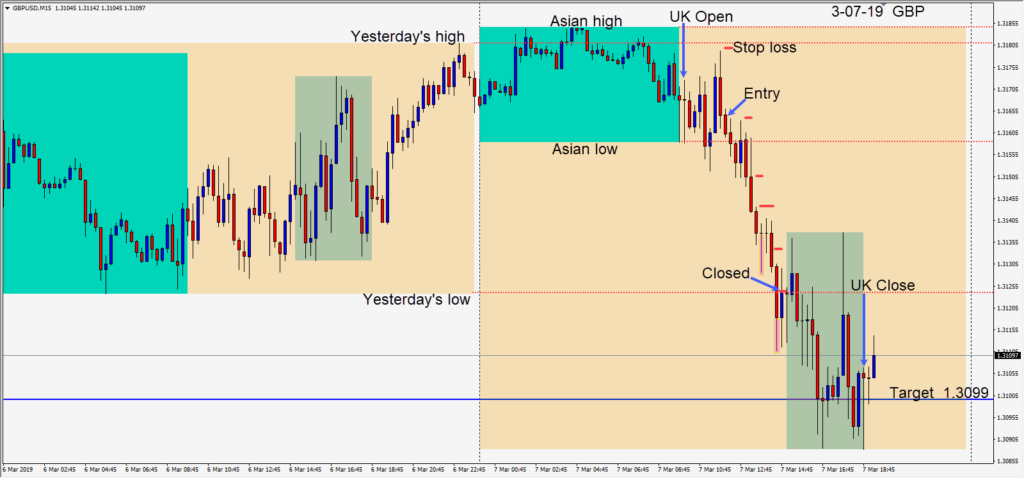

Not wanting to wait on the E.C.B. today, an opportunity to short the GBP presented itself, risking 16 pips for a potential 65 pips to our daily target at 1.3099. Price moved down but long lower wicks began to form before the U.S. open and E.C.B. Draghi’s eurozone commentary. Tightening our stop loss caused our trade to be closed at yesterday’s low as price retraced going into the U.S. open.

The USD gained more strength as the session continued and moved up to test its December high. Equity markets moved lower as “risk off” sentiment drove traders to safer asset classes.

Tomorrow we have the NFP release early in the U.S. session and it tends to create significant volatility – so be careful. Although the USD looks heavy at its current level, and the U.S. economy is slowing…it remains healthy and stronger than the alternatives. President Trump no doubt wants a weaker USD particularly with the record trade imbalance figure released yesterday but the market so far is not accommodating him this week. I remain USD bullish overall.

Good luck with your trading!