One week, we have USD strength, followed by USD weakness, followed by USD strength. It appears the bears and the bulls are both correct. Volatility and reversals are something traders needs to get accustomed to.

Fundamental analysis is very important but reading price and understanding simple technical analysis is how we make money and find trade setups. Money management and discipline are how traders survive.

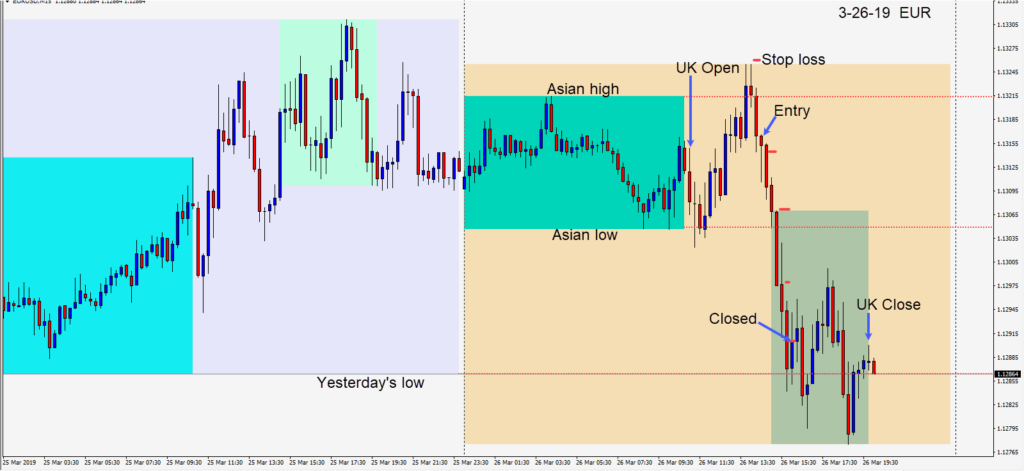

Today the EURUSD moved up from its Asian session lows, but was unable to sustain above its Asian session highs. A short was taken risking 10 pips for a potential 70 pips to our daily target at 1.1245. Price moved lower and continued lower as the U.S. session got underway. We kept our profit stop tight and ended up being closed for a modest gain.

The market continues to be focused on the U.S. – China trade talks and Brexit outcomes. New potential scenarios are popping up daily with Britain, and this has kept the GBPUSD well above 1.3000 for the time being as a hard Brexit remains at bay. The yield inversion reaction appears to be a little premature in my opinion.

Note: My postings may continue to be less frequent over the next couple of weeks due to someone very close to me being very ill.

Good luck with your trading!