The NFP number was the worst since September 2017. The reaction was to sell the USD. The yen was not an immediate beneficiary but gold moved upward in sight of $1300 again. It’s not surprising after the USD had a solid move up this week – testing its December highs that a poor employment number would cause a pullback.

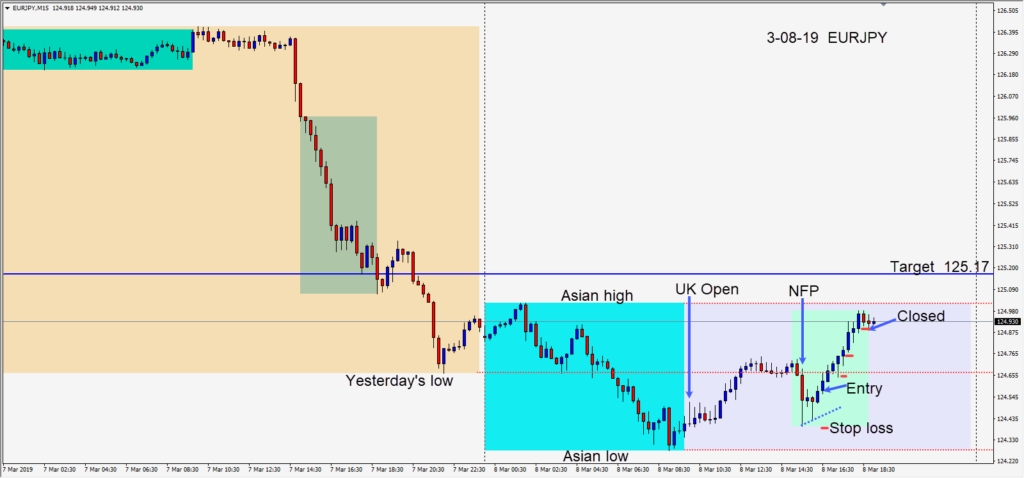

The euro was stronger today after the major selloff yesterday. With a move up in the EURUSD and the USDJPY , a countertrend entry long was found on the EURJPY risking 20 pips for a potential 60 pips to our daily target at 125.17. The Asian session high had topped out around 125.00 but we fell short of testing the figure. Approaching the London close traders took profit going into the weekend.

The GBPUSD which was selling off further after the NFP release, moved up 70 pips and down 85 pips in a 15 minute period. If you are going to trade the pair use very tight stops and lock in profits because there may be more extreme moves as the Brexit deadline moves closer each day.

The U.S. – China trade talks continue to go well and this continues to be bullish for the USD. The NFP shortfall today happens from time to time and I’m not reading too much into it.

Good luck with your trading and enjoy your weekend!