Most of the majors are trending, but the daily ranges are confined and it’s been difficult the past couple of weeks to make more than 15 or 20 pips in a pair intraday. As a result, I have not been posting.

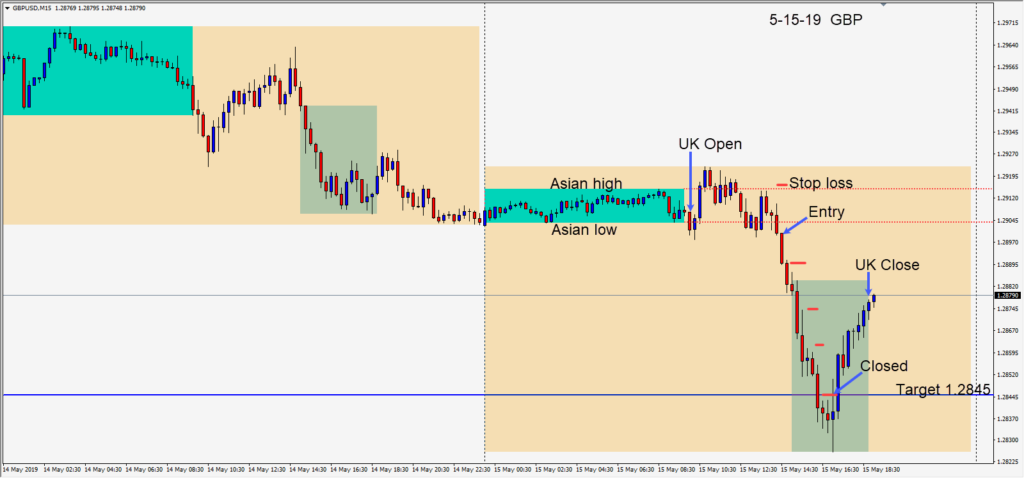

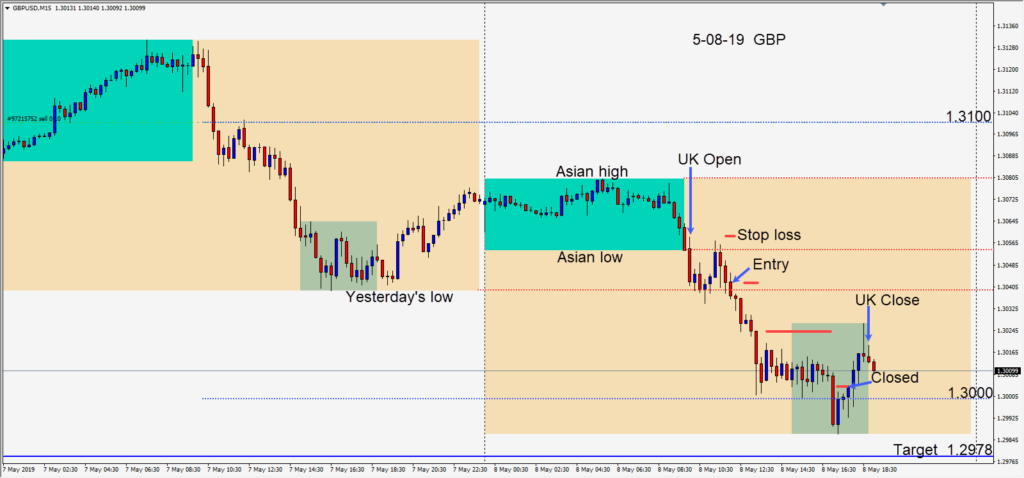

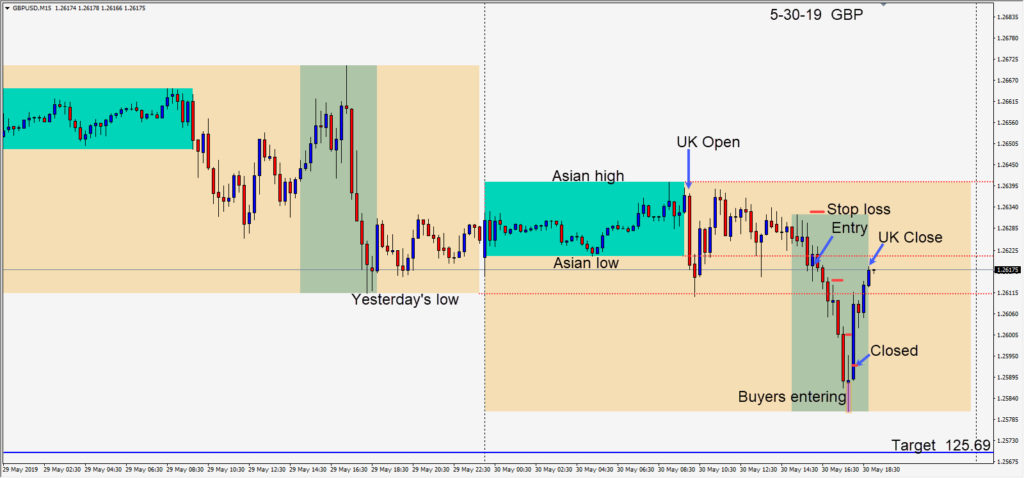

Today the GBPUSD gave us 25 pips to the downside. Risking 15 pips for a potential 49 pips to our daily target, we went short early in the U.S. session overlap. Price moved down to test yesterday’s low and continued lower. As a doji candle formed with a long lower wick, we tightened our profit stop to 25 pips and the trade was closed.

It seems that the U.S. – China trade talks lack of outcome has many traders on the sidelines for now.

British politics continue to weigh on the GBPUSD which may take out 1.2500 soon. The USDCAD continues to try to take out 135.00 and the USDJPY continues to move between 109.00 and 110.50 with 110.00 being a critical level. The EURUSD continues lower making lower highs and we will see if buyers come in above the 1.1000 figure. AUDUSD and NZDUSD are trending lower, but are moving a small number of pips each day compared to their normal range.

Tomorrow we enter month end and a week where the USD index has climbed each day. I would not be surprised to see it pulls back to test 98.00 before it climbs higher. Like the USDCAD, it may not be long it moves higher still.

Good luck with your trading!