The USD index continued to move higher today and we will see if it closes above 98.00 to end the week.

The Canadian dollar one would think would be having a good week too after favourable comments regarding the economy from the Bank of Canada’s Governor Poloz. WTI oil has continued upward this week, but the USDCAD continued higher. Is it because USD strength is offsetting the positive fundamentals of the Canadian dollar?

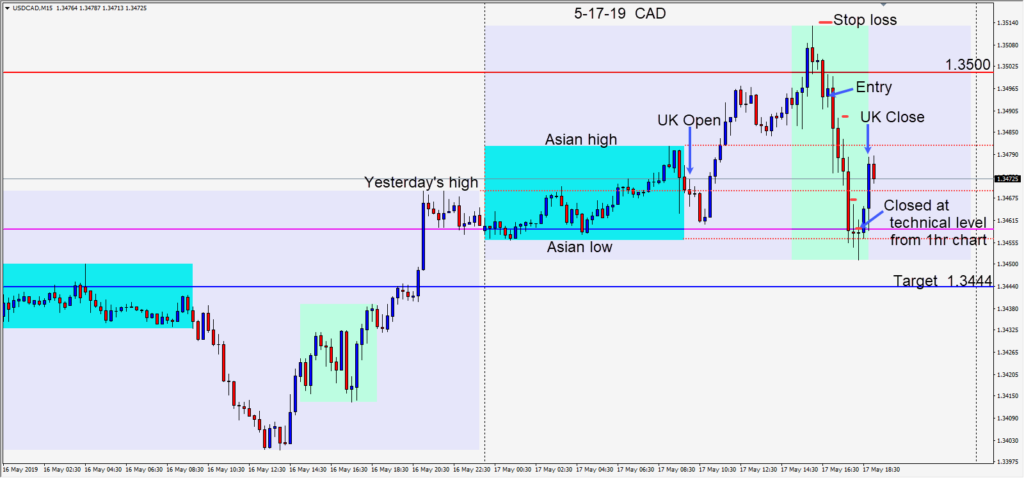

At 1.3500 the USDCAD tends to reverse lower. Today was no different and a short was taken risking 20 pips for a potential 49 pips to our daily target at 1.3444. As the reversal unfolded, price moved lower and appeared to bounce at its Asian session low. It is typical for price to test and retest certain levels, and on the hourly chart a very important technical level acted as support and our trade was closed protecting profits at this level.

It’s hard to know if the catalyst for the move lower today coincided with rumours circulating that the U.S. and Canada had come to an agreement removing U.S. tariffs on Canadian steel and aluminum. The 1.3500 figure continues to be formidable resistance for the USDCAD for now.

Monday is a holiday in Canada.

Enjoy your weekend and good luck with your trading!