The markets have been waiting for a positive end to the U.S. – China trade talks, but the drama continues and the sentiment is “risk off” today.

A currency pair that is useful for gauging risk is the Australian dollar Japanese yen. The Aussie being a commodity currency and the yen being a safe haven currency.

In the current political climate, with the disappointment from the lack of progress in the U.S. – China trade talks, the market has been scrambling for safety since President Trump’s tweets from Sunday a week ago. As tariffs increased on Friday for China, it is no surprise that China is retaliating against the U.S. – particularly in light of further comments made by President Trump since. The markets were expecting progress and lead to believe that an agreement was near. The markets have taken a big step back now and riskier assets continue to be sold.

For a Monday it was pretty exciting and almost any pair was easy to trade.

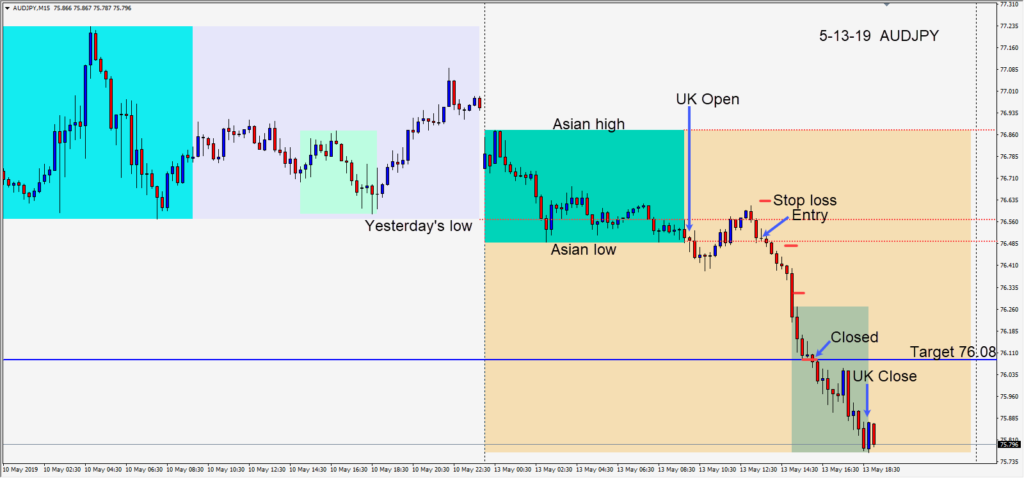

We entered the AUDJPY short risking 12 pips for a potential 42 pips to our daily target at 76.08. Price had already lured the breakout traders in at the London open and stopped them out with a pullback. We entered hoping to be well into profit before the U.S. open. Protecting our profit as price descended and closing the trade at our daily target worked well. With the faltering USD it appeared that we could have stayed in for longer but tomorrow is another day.

The USD has been weakening this past week, but so far the DXY has held above 97.00. The U.S. economy continues to be very strong and although the news is disturbing for the markets at the moment, this too shall pass.

Good luck with your trading!