These are tricky times to trade and trends may be changing.

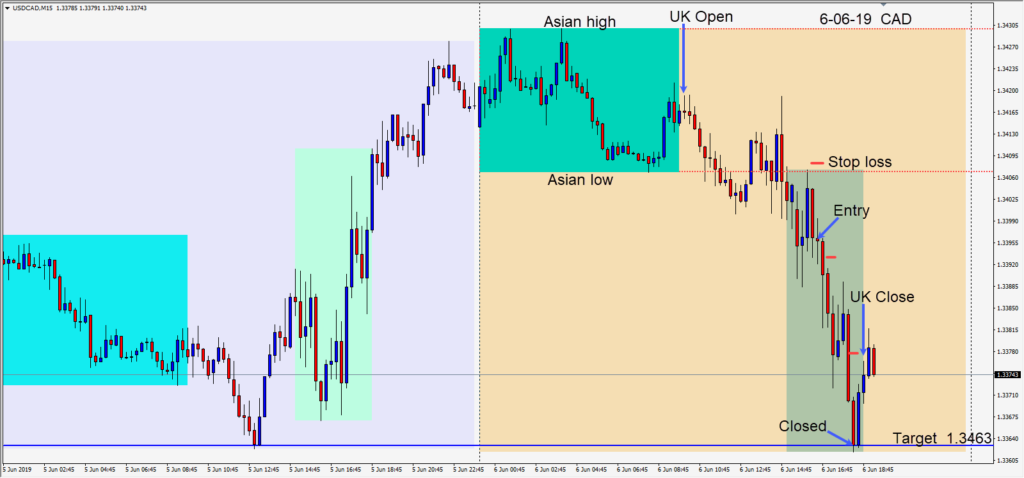

Despite a surplus in crude oil inventories this week, the USDCAD moved lower today. As it failed to stay above the 1.3400 figure, a short was taken early in the U.S. session risking 12 pips for a potential 33 pips to our daily target at 1.3463.

Price moved lower to our target before the U.K. close and we were happy to have an intraday trade this week that moved over 20 pips. A long taken yesterday after the crude oil inventories announcement ended up netting us 1 pip.

Having been a USD bull for months and months, I am now neutral on the USD.

The U.S. economy continues to be strong, but less strong than a year ago. The Federal Reserve raised interest rates to prevent the economy from becoming overheated…and it worked. President Trump has been highly critical of the Fed and outspoken about wanting interest rates lower. The U.S. is certainly in a position to lower interest rates and now the market believes the first interest rate cut is imminent…possibly this month or next.

The failure thus far of a trade agreement between the U.S. and China, after the White House had been reporting that an agreement was very near – and then wasn’t, didn’t help the global financial confidence.

This week White House economic advisor Kevin Hassett resigned. Mr. Hassett has been a proponent of free markets and free trade…not a popular stance with the current president.

President Trump’s notion of imposing new tariffs on Mexican goods imported into the U.S. casts doubt on negotiated trade agreements with the U.S. The trade protectionist policies now appear to be having a detrimental effect on the USD. This too may please the president, as U.S. exporters will benefit. If interest rate cuts are announced by Chairman Powell, this will please Wall Street, but may add to further selling of the USD.

Tomorrow’s non-farm payroll release is likely to create volatility, so be careful.

Good luck with your trading!