The EURUSD has surged higher since the Fed announced a pending U.S. interest rate cut in July which has weighed heavily on the USD. Like a rising tide raising all boats, all the majors have strengthened to the USD.

Currently, buyers are emerging around the 1.1340 area and until this area gives way to the downside, price may move higher to test 1.1400.

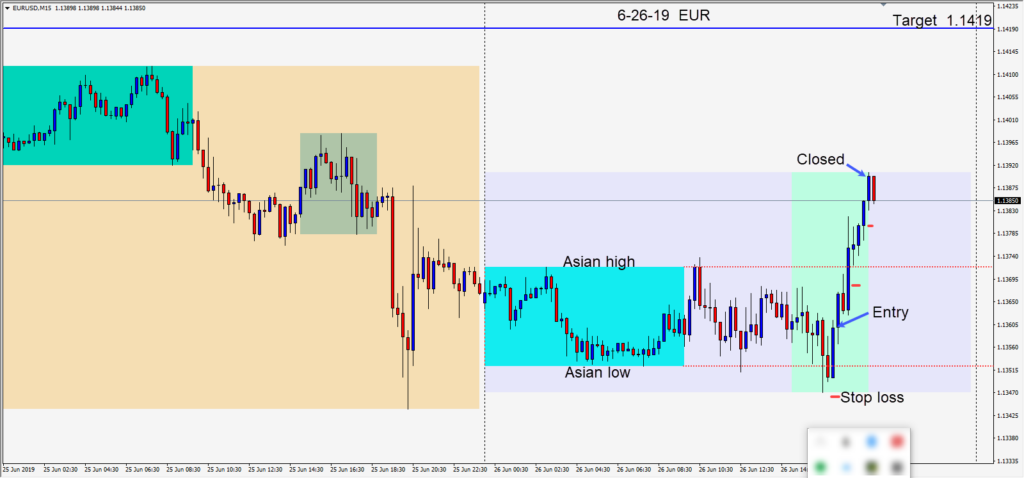

After price initially moved lower in the U.S. session overlap, a large bullish engulfing candle formed, and a long was taken risking 14 pips for a potential 59 pips to our daily target at 1.1419.

Price moved higher above its Asian session high, retested the level and climbed higher going into the U.K. close…where the trade was closed.

Markets are likely to be cautious ahead of the G20 summit with hopes for a positive outcome between the U.S. and China regarding trade talks. Keep an eye on the U.S. 10 year yield and gold for market sentiment.

Good luck with your trading!