Britain now has Prime Minister Boris Johnson leading the Brexit challenge and hoping to accomplish what Teresa May was unable to complete.

The uncertainty as to how the divorce from the E.U. will be accomplished by October 31st will likely continue to weigh on the GBP regardless of the political rhetoric.

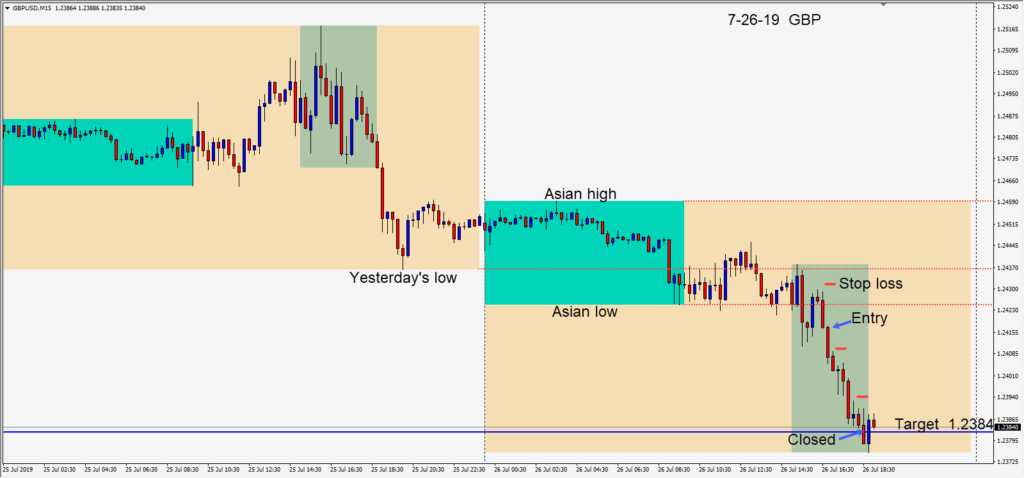

With persistent USD strength this past week and uncertainty in Britain, the GBPUSD set up nicely for a short on Friday risking 14 pips for a potential 34 pips to our daily target at 1.2382.

This trade was a little tricky in that on a Friday how likely is it that the GBPUSD would break and stay below the 1.2400 figure…but it did and it made its way down to our daily target for a satisfying trade.

On July 31st the market remains uncertain as to whether the U.S. Fed will cut rates by 25 or 50 basis points. President Trump will certainly be hoping for 50 bp – but it is not up to him. Usually lower interest rates will cause a currency to weaken but this may not be the case if the Fed only cuts by 25 bp. Expect some volatility on Wednesday and keep in mind that the first move the market makes after the announcement will be reactionary and it is easier to fade a reactionary move that to chase it.

Good luck with your trading!