Currency daily ranges in the majors have been subdued for some time now, likely due to the uncertainty of progress with the U.S. – China trade talks.

It’s difficult to get too excited about trades under 20 pips, so I prefer not to take the time required to post them. I will make an exception today because I haven’t posted a trade for a couple of weeks. The small trades add up, but it seems like we need twice as many trades lately. This will pass, but in the meantime I won’t be posting many small trade examples.

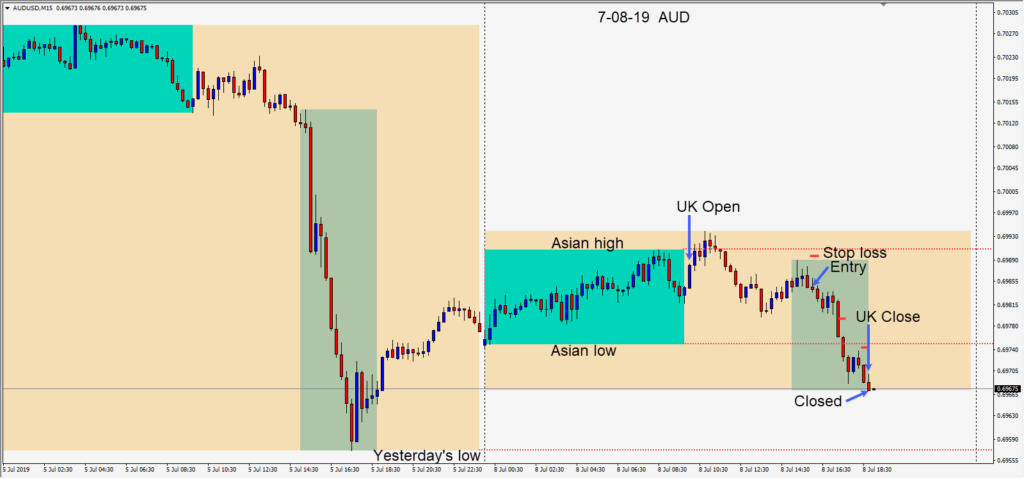

Today with continuing USD strength after the impressive NFP number on Friday, a short was taken in the AUDUSD risking 6 pips for a potential 46 pips to our daily target at .6938. The setup looked good, price moved downward and we closed the trade at the U.K. close for a very modest gain.

It would have been nice if price had moved to at least Friday’s low before the close but it wasn’t to be.

Tomorrow early in the U.S. session, Fed Chair Powell will be speaking and traders will be listening closely for any hint of a rate cut exceeding 25 basis points this month. As President Trump’s harsh criticisms of the Federal Reserve continue, the market will be looking for signs of Jerome Powell capitulating… or not.

Good luck with your trading!