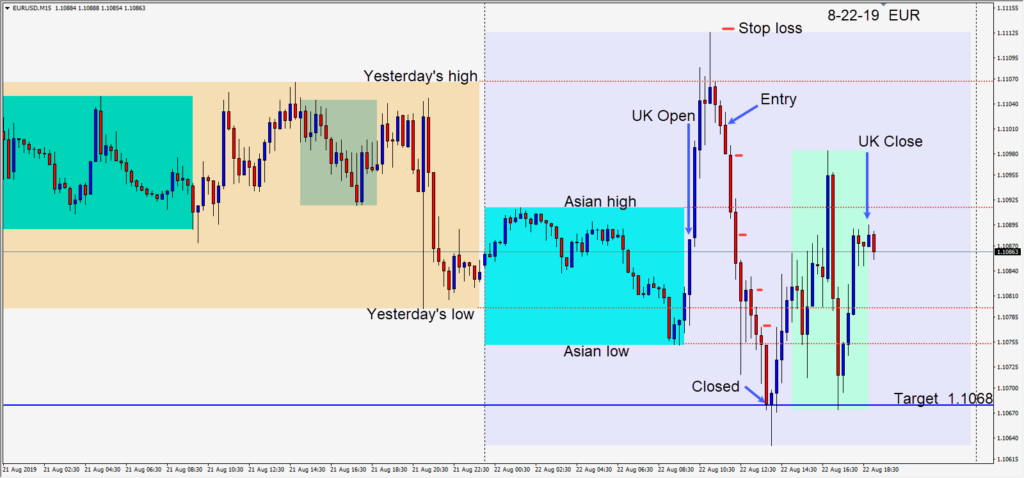

The EURUSD moved quickly higher as the U.K session got underway and vertical moves are not sustainable. As the sellers entered above yesterday’s high and price made two red candles, a short was taken risking 12 pips for a potential 33 pips to our daily target at 1.1068.

This is a high probability trade setup and the pattern would be complete if price had just made it back down to its Asian session low. Price tends to retest important levels and after a quick bounce higher, price continued to our daily target and closed the trade.

It’s been a tricky week. Traders have been waiting on Fed Powell’s comments on Friday at Jackson Hole for further clues as to U.S. interest rate cuts and the health of the U.S. economy. The lack of resolution in the U.S. – China trade talks is not helping the U.S. or world economies.

I’m surprised that the 1.1000 level has held up this long for the euro and a bigger surprise is that the 1.2000 level has yet to be breached in the GBPUSD.

I’m still comfortable shorting in to both when the setup presents itself but expect a bounce at these levels in the near term.

Good luck with your trading!