My preference will continue to be to short the GBPUSD on days of USD strength coupled with nothing favourable coming out of the U.K. – Brexit-wise.

It wasn’t that long ago that this pair could find some contrarians (buyers) on dips below 1.2500. Now 1.2000 is in sight, where it will likely have some difficulty getting through and moving lower…although a 34 year trendline low is at 1.1960.

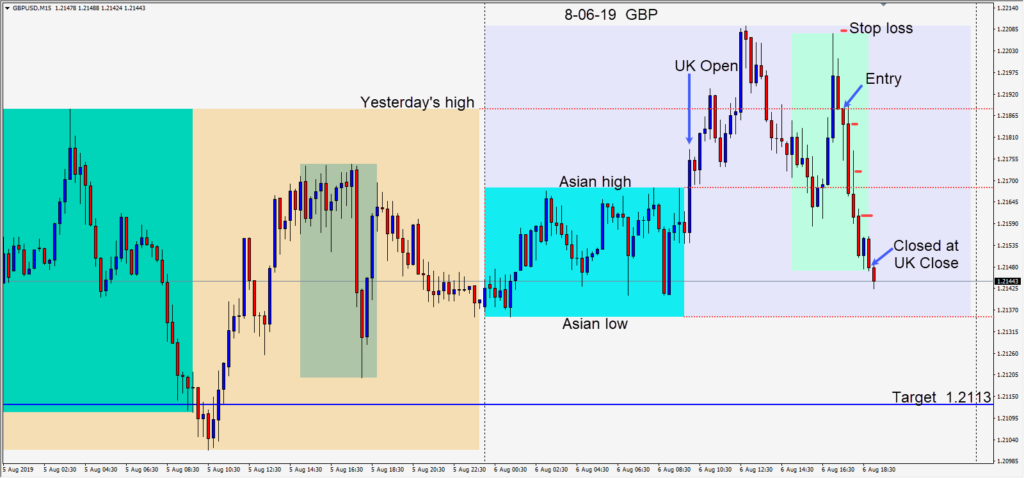

Today as the pair rallied and failed early in the U.S. session overlap…making a lower high, a short was taken risking 20 pips for a potential 74 pips to our daily target at 1.2113. Price moved lower and we closed the trade at the U.K. close.

We may as well get used to it, President Trump has an interesting style of negotiating. After positive comments of progress being made with the U.S. – China trade talks last week, harsh criticism of China followed and optimism for resolution diminished once again. As the global economies slow even further, the likelihood of further interest rate cuts in the U.S. increases.

Good luck with your trading!