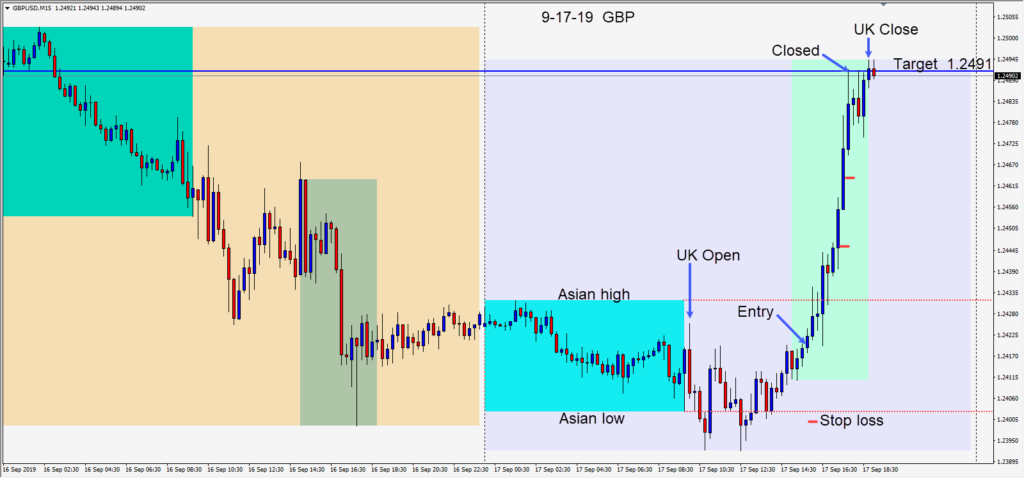

I can’t remember the last time I took a long on the GBPUSD. Brexit is not behind us, but the charts looked very good today for a move up to the 1.2500 area.

A long was taken early in the U.S. session risking 20 pips for a potential 71 pips to our daily target at 1.2491. The news calendar was light and the pair found more buyers as it climbed to test its Asian session high. This level was tested and retested before price moved quickly up to our daily target where the trade was closed.

A close above 1.2500 today is bullish and the 1.2735 area become a target to test going forward. With negative news regarding Brexit or military intervention against Iran, the pair is likely to move lower…beginning with a test of the 1.2400 figure.

Tomorrow the U.S. is expected to lower interest rates by 25 bp and traders will be listening closely to Fed Chair Powell’s comments regarding any concerns for the U.S. economy that would suggest another 25 bp cut or more by year end.

It will be interesting to see what President Trump decides to do regarding the strike on the Saudi oil facility. Oil is off its highs as the Saudis are expecting to be back up to capacity within a few weeks…if not by month end.

Good luck with your trading!