The currency markets have calmed down after a very reactionary and volatile several months. In my opinion, the markets are looking much more tradeable now. The U.S. – China trade agreement although not yet signed is looking like phase one will now be signed in December.

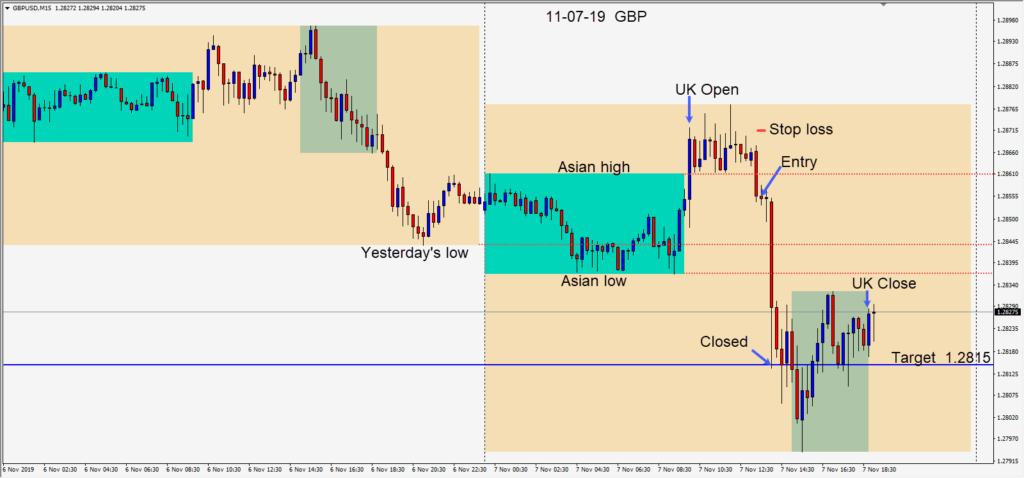

The U.K. election is still over a month away. With the Bank of England rate decision, meeting minutes, and Governor Carney’s press conference today, it felt safe to take a short on the GBPUSD before the event. It seemed highly unlikely there would be a rate change so close to the election. Risking 15 pips for a potential 40 pips to our daily target at 1.2815 – an entry short was taken. It paid off well and quickly, but I can understand why many traders would prefer to wait until after the announcement and conference before jumping in.

The GBPUSD has been trading between 1.2800 and 1.3000 recently. A break lower opens up a test for 1.2700 and 1.2650. A break higher above 1.3000 will likely test 1.3075.

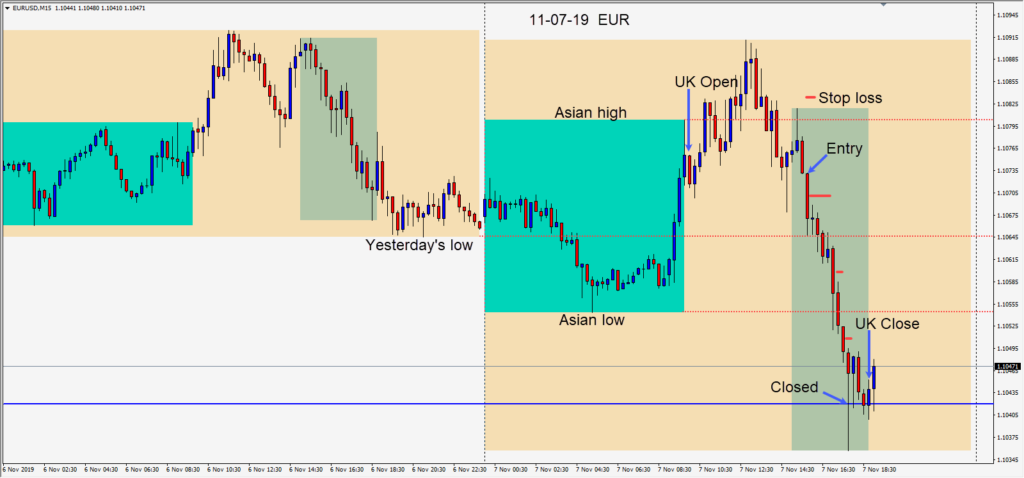

The EURUSD set up for a nice short today as it pushed lower early in the U.S. session overlap, after failing to find buyers above its Asian session high. We entered short risking 10 pips for a potential 30 pips to our daily target at 1.1042.

A continued move lower will have difficulty getting through the 1.1000 figure. Any sustained moved beneath 1.1000 and 1.0925 then 1.0880 area become technical targets.

Good luck with your trading!