It appears that the U.S. – China trade agreement phase 1 is done, but the details remain vague still. Regardless, the equity markets are up, as is the U.S. 10 year yield today.

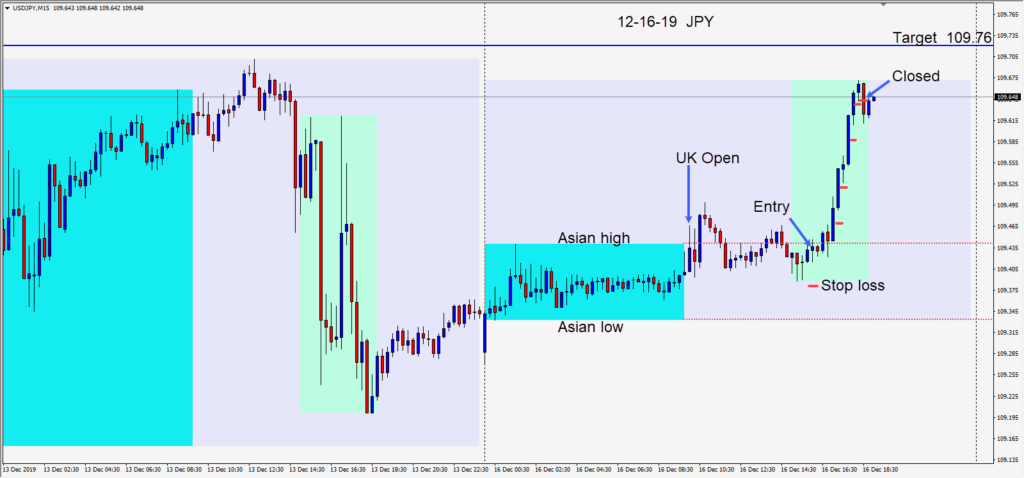

A long was found in the USDJPY risking 5 pips for a potential 33 pips to our daily target at 109.76. Price had found a bottom and began to move higher in the U.S. session overlap. As price moved upward, we moved our stop loss to a profit stop and continued to lock in profit as price continued higher.

The markets are very volatile of late, and in my opinion it’s better to lock in profit along the way, than to lose it due to headline or tweet volatility -which we have seen occur many times this year.

The other major boost to the markets (for now) is Boris Johnson’s large Conservative majority in the U.K. The GBP strengthened quickly but trading it particularly after the huge gap was a risky endeavor. With strength it may well test 1.35 again and with weakness it may come back to retest 1.3250 or lower before finding buyers.

Hopefully there will be lots of trades this week before we move into the holidays.

Good luck with your trading!