The optimism surrounding the signing tomorrow of the U.S. – China Trade Agreement Phase One hasn’t helped the DXY to close above 98.50 and gold continues to find buyers near $1540.

The Core CPI (YoY) met market expectation today and the shortfall in the more volatile Core CPI (MoM) didn’t cause much of a knee jerk reaction.

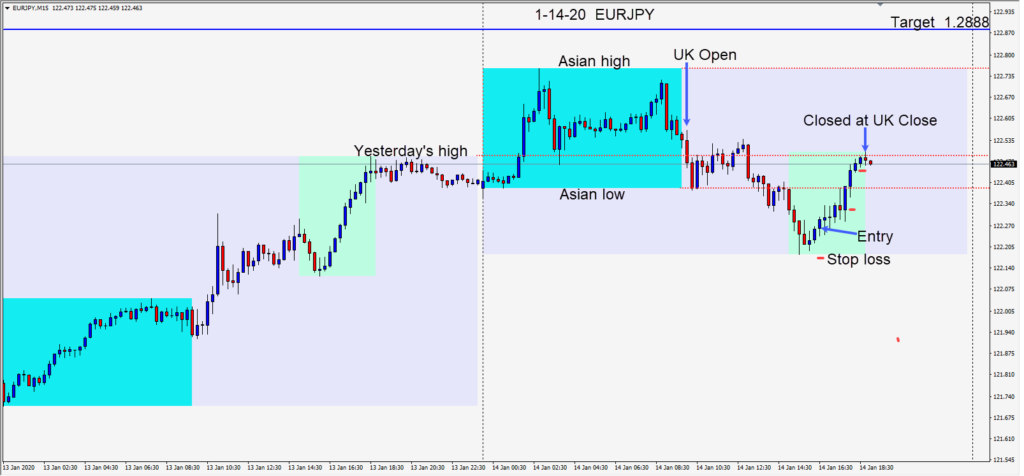

A similar setup to yesterday enabled us to find an entry again in the EURJPY, risking 10 pips for a potential 62 pips to our daily target at 1.2888. Price moved higher and tested its Asian session low, then moved up to test yesterday’s high where we closed the trade at the end of the U.K. session.

The U.K. releases CPI and PPI data tomorrow. BoE MPC Saunders will be speaking too. The market is looking for soft data and further dovish comments for the likelihood of a rate cut coming sooner than later. The current consensus is about 50% likelihood of a rate cut at month end.

Reaction to the signing of the U.S. – China Trade Agreement Phase One will be interesting as more details emerge tomorrow.

Good luck with your trading!