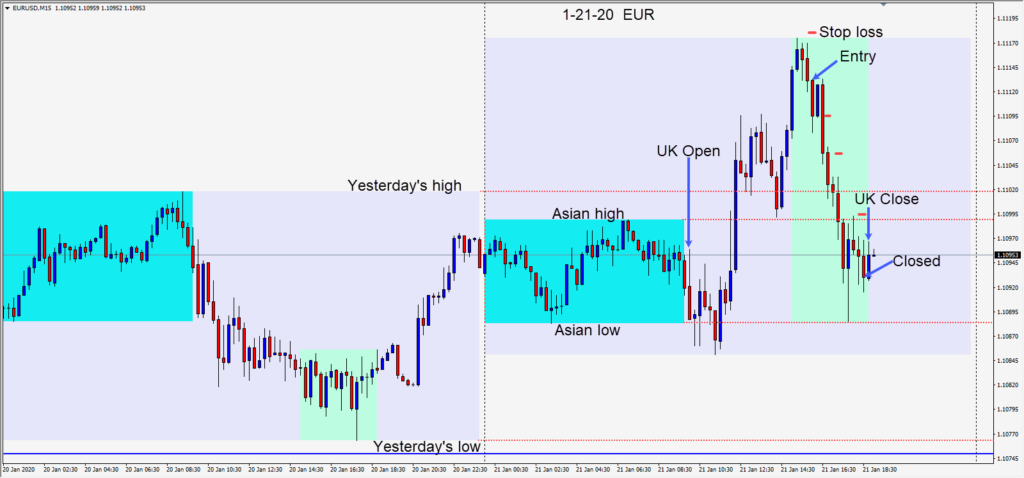

Some positive economic releases early in the U.K. session brought the EURUSD buyers in and as the U.S. session got underway a top formed and a short was taken risking 5 pips for a potential 38 pips to our daily target at 1.1075.

The EURJPY was an alternative trade setup, but the stop loss was more expensive than on the EURUSD. With a cautious tone to the market today, either trade was attractive.

The idea was to ride the EURUSD down to its Asian low and hopefully down to our daily target at 1.1075 before the U.K. close. On its first test of the Asian session low, buyers stepped in and price quickly tested its Asian session high before it started to fade again.

The trade was closed a candle before the U.K. session ended to avoid any volatility going into the close as positions were liquidated. This a fifty/fifty proposition… as whose to know if the sellers are going to take control? With the EURJPY also bouncing off its Asian session low, it seemed better to take profit and come back tomorrow.

The 1.1070 level looks like it may be tested shortly and that will open the door for a test of 1.1050 and 1.1000 going forward for shorts.

The GBPUSD has found buyers below 1.3000 but the market is positioning itself for a potential B.O.E. rate cut on January 30th. Weak economic news before then strengthens the market’s bearishness, but today we saw better than expected numbers for Britain.

Shorts will be eyeing the 1.2980 level then 1.2950. A move below 1.2950 would open the door for a test of 1.2900 figure.

With the corona virus causing some fear in Asian trading, USDJPY shorts could push the pair below 109.70 where it could accelerate further to the downside.

Good luck with your trading!