February’s final week of trading comes to a close with a surprise ending. Just over a week ago the U.S. equity benchmark S&P 500 made an all time high. The coronavirus seemed largely contained in China and last weekend with a major number of new cases reported in South Korea and then Italy, the world equity markets went into a freefall. This created further fear and the equity markets fell all week…and not in small terms.

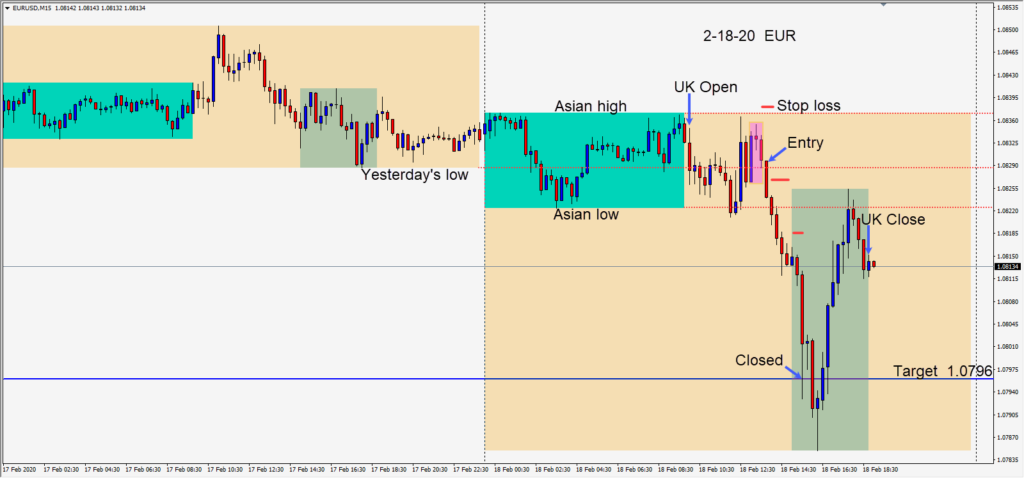

I have been waiting to short the EURUSD for a couple of weeks – waiting patiently for it to break 1.0775 – it has strengthened instead and moved above 1.1000 today. Fading bounces can be very profitable but choosing entries is the trick and it’s not a good idea to swim against the current. Last Friday we saw disappointing PMI numbers in the U.S. and surprisingly good PMI numbers out of Europe. The USDX has dropped from nearly breaching 100 to 98.41 at time of writing.

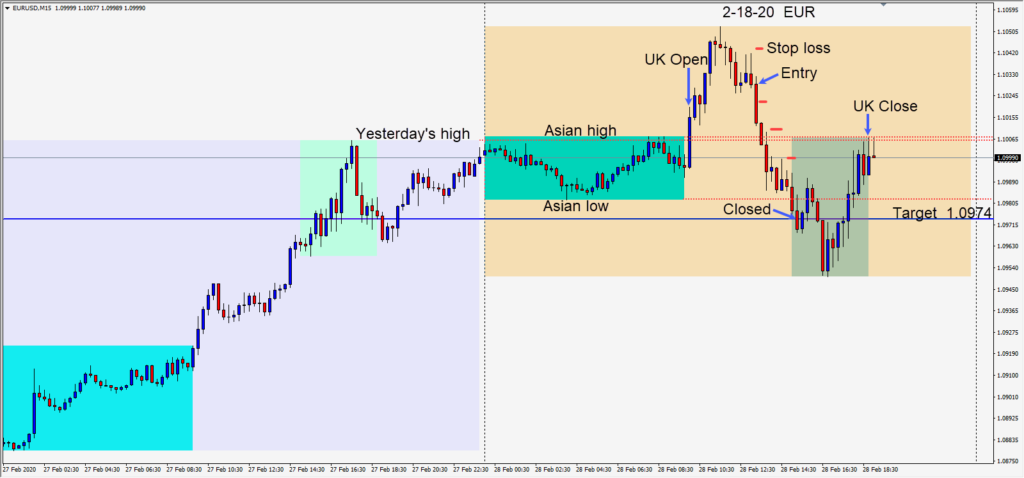

Today as the EURUSD continued its climb above 1.1000 but appeared to rollover around 1.1050… a short was taken after a near triple top failed. We entered short risking 16 pips for a potential 54 pips to our daily target at 1.0974. As price moved lower, we immediately took the risk out of the trade moving our stop loss down to ensure a profitable outcome. The idea was to trade the pair down to the 1.1000 figure and tighten up the profit stop allowing for a possible bounce there. As price continued to move down going into the U.S. open, we tightened our profit stop to 1.1000 then lower and our trade was closed at our target.

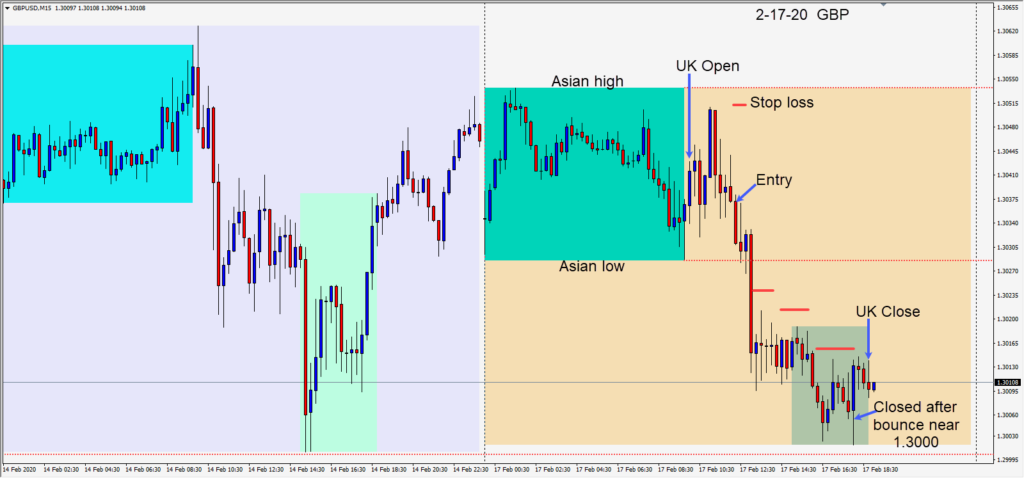

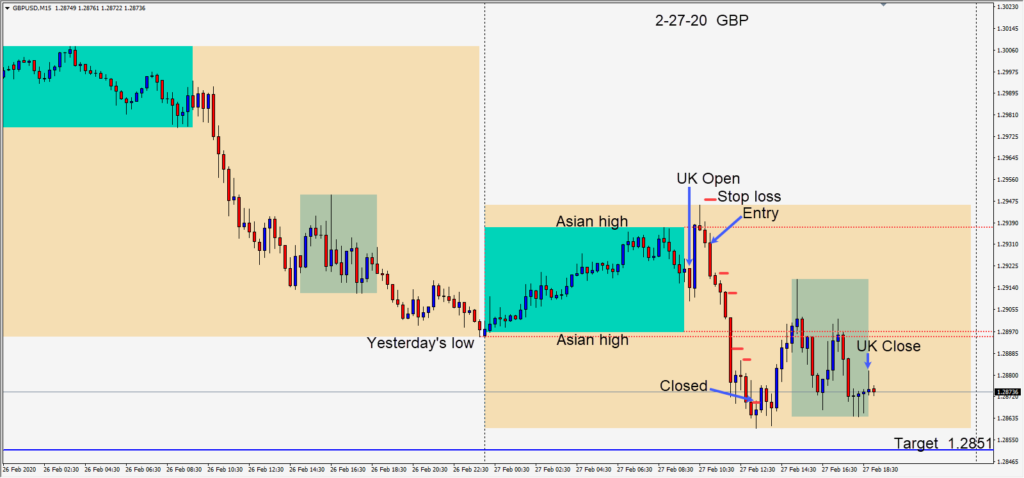

Yesterday, the GBPUSD set up for short trade as rhetoric heated up between Britain and the E.U. When the pair failed to exceed its Asian session high and moved lower, a short was taken risking 17 pips for a potential 80 pips to our daily target at 1.2851.

Price moved lower and accelerated through its Asian session low and the previous day’s low. We further tightened our profit stop as price continued lower and our trade was subsequently closed on a bounce.

Next week will be an interesting week for the euro and sterling as the two sides further negotiate the Brexit divorce.

Interestingly the flight to safety has decimated the US 10Y yield each day this week with it being off at time of writing by over 8% just today! Gold curiously is being sold off and is currently down over $73 U.S. today. Where the U.S. equity markets close is anyone’s guess but it’s not looking good with just over two hours left.

Next week will be another interesting week and no doubt filled with coronavirus headlines…hopefully positive ones.

Good luck with your trading and enjoy your weekend!