Despite the daily headlines about the coronavirus, a “risk on” sentiment prevails in the financial markets. The USDX continued to climb for a third straight day as fears about the spreading of the coronavirus outside China abate somewhat.

Although shorting the GBPUSD was very appealing today, the size of the stop loss was more than twice the size of the stop loss for a EURUSD short.

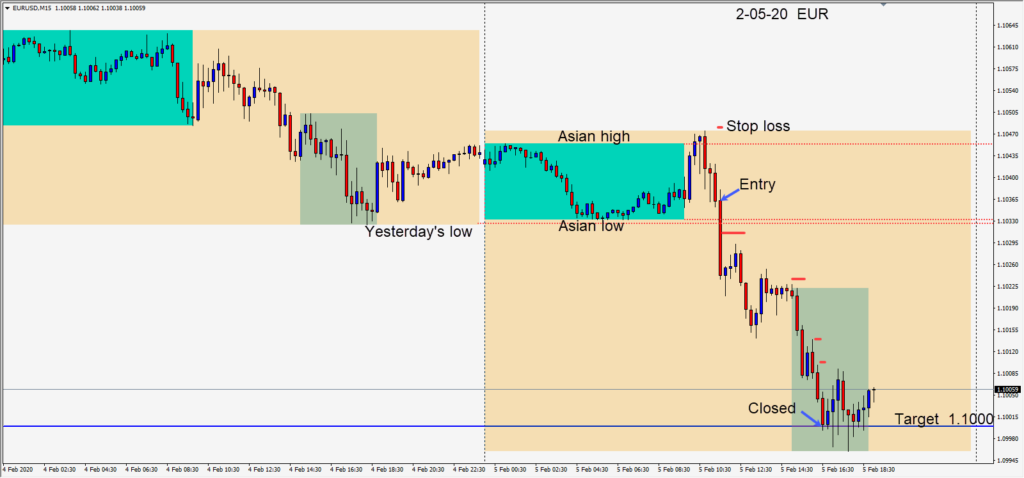

Risking 12 pips for a potential 36 pips to our daily target at 1.1000, we entered the EURUSD short instead.

Price plunged lower through its Asian session low and yesterday’s low. We moved our stop loss into profit and awaited the considerable economic news today to pass, while protecting profit. Price continued lower touching our daily target closing the trade at 1.1000.

The 1.1000 big figure is going to attract buyers but my preference remains to short the EURUSD when combined with USD strength. If 1.1000 gives way after a retest, look for buyers near 1.0950 and 1.0900.

Brexit is not going to be easy and if the 1.3000 figure doesn’t hold, I will be looking for buyers to emerge near 1.2950 and 1.2900 going forward. My preference is similar to the EURUSD – short when combined with USD strength.

As for USD strength, it won’t go up every day and it will take some effort for the DXY to get above and stay above 98.40. Be cautious at these current levels and be cognizant of the NFP release this Friday.

Good luck with your trading!