Monday was an exceptional selling day as the markets reacted to the implications of a pandemic risk for the coronavirus.

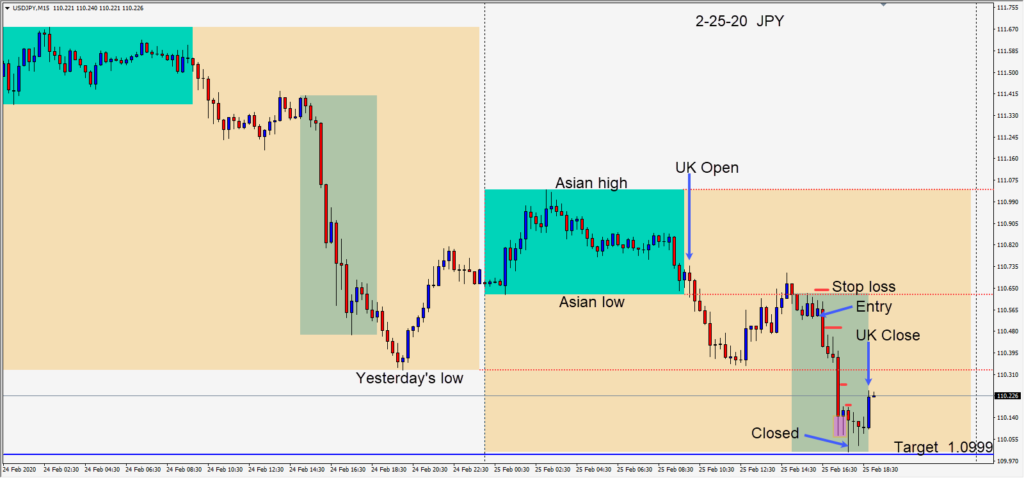

On Tuesday the USDJPY moved down but found some buyers near Monday’s low and retraced upward. As the U.S. session got underway, it began to move lower and a short was taken risking 12 pips for a potential 54 pips to our daily target at 109.99.

Price moved lower pushing through Monday’s low then headed to test the 110.00 big figure. With a couple of candles showing long lower wicks (indicating buyers entering) we tightened up our profit stop and targeted 3 pips above the 110.00 figure as our target to close the trade.

We ended the year 2019 with hope that the global economic slow down had abated and Europe was beginning to show signs of inflation. The U.S. – China trade talks had succeeded with a Phase One deal in the making.

In January the coronavirus appeared in China in record numbers, but overall seemed to be somewhat contained within China – with implications of a slowing China economy as a result. Since we live in a global world where people travel, the virus has spread to multiple countries around the world which has very negative implications. As a result the markets are reacting to the fear of what may transpire from here.

Don’t fight the market and trade what you see today as opposed to how you may think this will eventually play out.

Good luck with your trading!