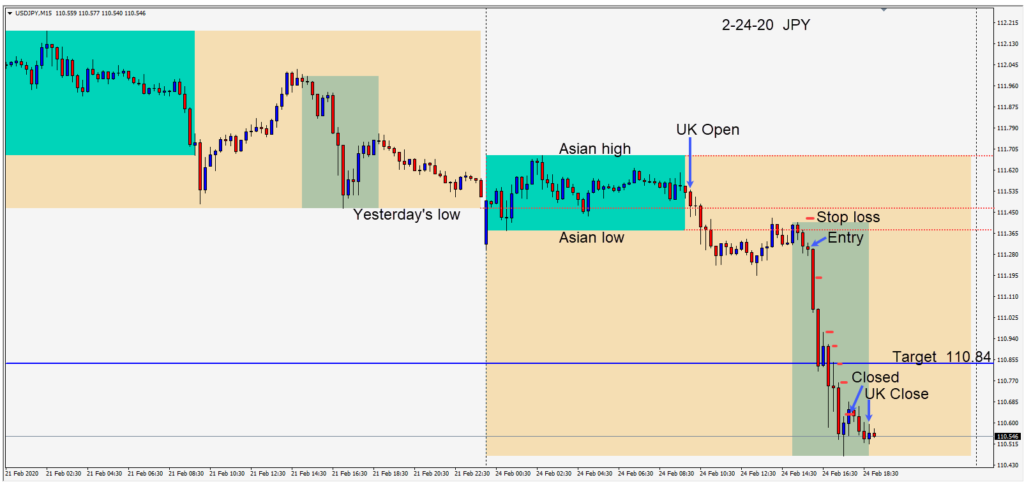

A light day of economic news releases but a significant number of new cases of the coronavirus outside of China has unnerved the markets. As risk off sentiment begins the trading week and the USD remains on its back foot following the weaker than expected PMI numbers on Friday, a short was taken in the USDPY.

Risking 12 pips we entered the trade targeting 45 pips to our daily target at 110.84. As global equity markets were in a tailspin and the the S&P futures pointed to a major sell off at the open, this trade looked like it had potential for a large move.

We removed the risk from the trade quickly as price moved down, but gave it some room. (Last week by having a profit stop a little too close, we had a trade closed just before it dropped vertically.)

As price moved lower today, and the U.S. equity indices sold off heavily, we tightened the profit stop to the high of each previous candle until our trade was closed.

With the positive numbers coming from Germany last week, catching the market offside, the Euro has been able to bounce and the 1.0775 level mentioned last week has not given way yet. My bias remains to the downside as I expect shorts to enter just under 1.0900 on bounces and more shorts to enter around the 1.0950 level.

Remain cautious and nimble.

Good luck with your trading!