There was a big sell-off in the GBPUSD when the Bank of England cut interest rates by 50 basis points today. The 50 bp cut is the same as what Australia, the U.S. and Canada did last week.

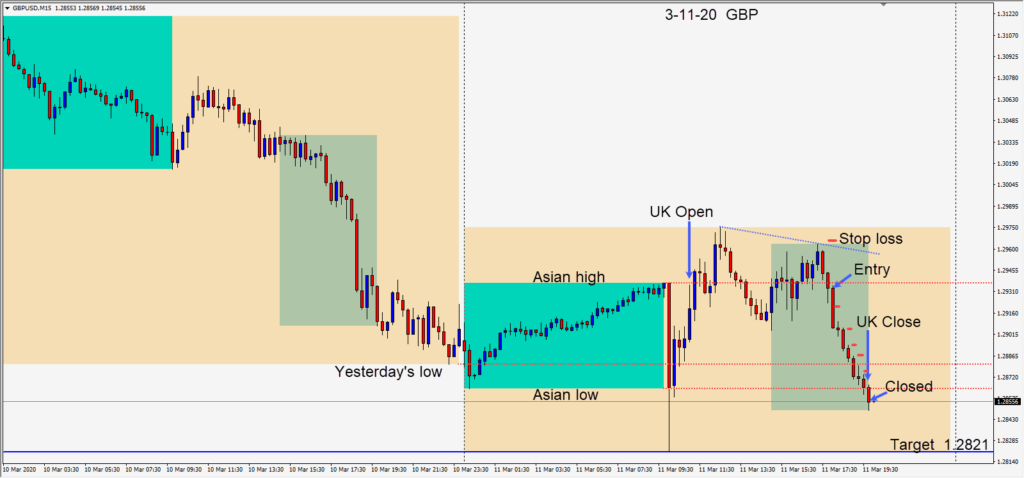

Once the economic news releases were behind us today in the U.S. session overlap, a short was taken risking 33 pips for a potential 111 pips to our daily target at 1.2821. With a larger than usual stop loss, the idea is not to risk any more proportionately of one’s account than usual. A smaller position is taken and the idea is to remove the risk from the trade when price has moved in our favour.

After the very first candle price had moved sufficiently lower for us to lower our stop loss to a profit stop, should price reverse quickly.

As price continued lower, especially as we approached the end of the U.K. session, we locked in more profit with each candle. We closed the trade at the close of the U.K. session.

The reason we don’t trade in front of Central Bank rate decisions is exemplified today with a 115 pip candle at the time of the announcement. We never know exactly how the market will react to the news and accompanying statement. It’s also why stop losses are always used.

The coronavirus continues to dominate the headlines and the financial markets are awaiting better news, fiscal stimulus and defined relief assistance to offset its negative consequences.

Good luck with your trading!