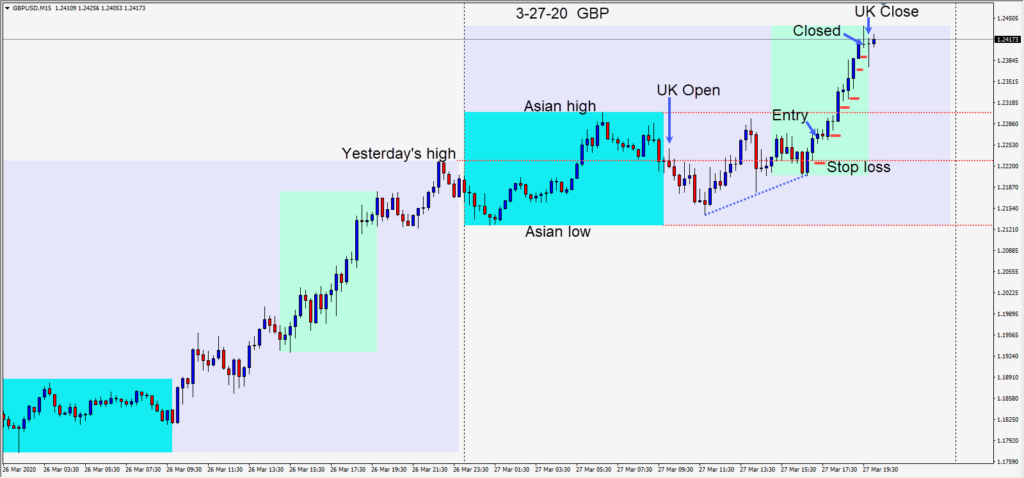

The GBPUSD surged 450 pips off its low on Thursday breaking through the 1.200 level and still continued up 225 pips. Today after a pullback in the early U.K session it began to move higher again.

After an early double bottom and a further push higher in the U.S. overlap, an entry was taken risking 40 pips. Our daily targets this week have not been that useful on the GBPUSD due to its extreme moves.

As price moved higher to test its Asian session high, we removed the risk from the trade and placed our profit stop to plus one pip. Price broke above its Asian session highs and we continued to lock in profit as it moved higher. After a long upper wick formed with a candle closing near its low, we exited the trade in advance of the session close.

Among the many notable occurrences of the week, the vertical move down of the USD was very interesting as it traded until today, inversely to the U.S. equity markets. Today… going into a weekend the equity markets plunged after 3 days of exceptional gains and the USD continued lower still.

The number of coronavirus confirmed cases continues to climb each day in much of the world. Prince Charles, Boris Johnson and the UK Health Secretary are reported to have tested positive this week. The U.S. surpassed the number of cases in China and emergency measures are being taken by most countries. Now that China has an upper hand on the virus, they are helping other countries with what they have discovered.

These are exceptional times in which we live and trading is fascinating, rewarding and at times quite frustrating as the currencies move erratically back and forth.

Be safe and healthy!

Good luck with your trading!