Today was another day of USD weakness and it’s never wise to fight the market.

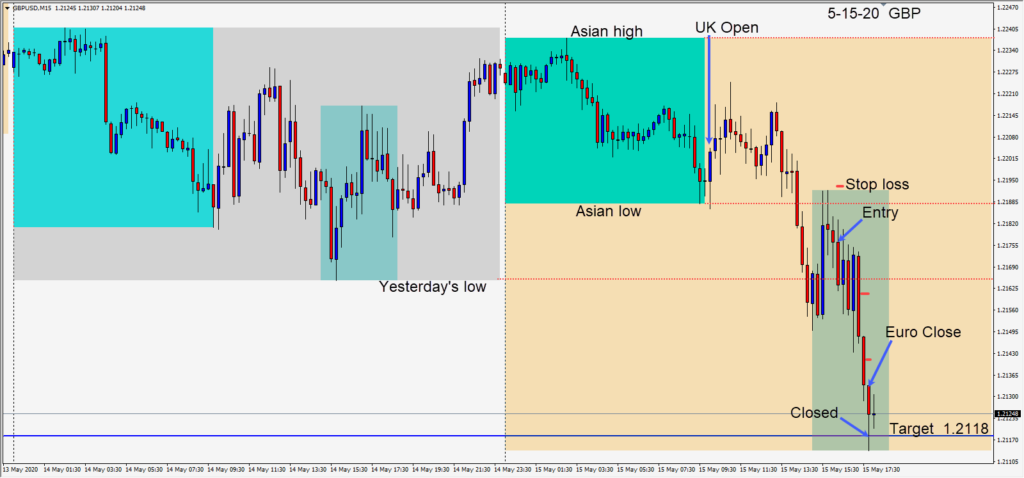

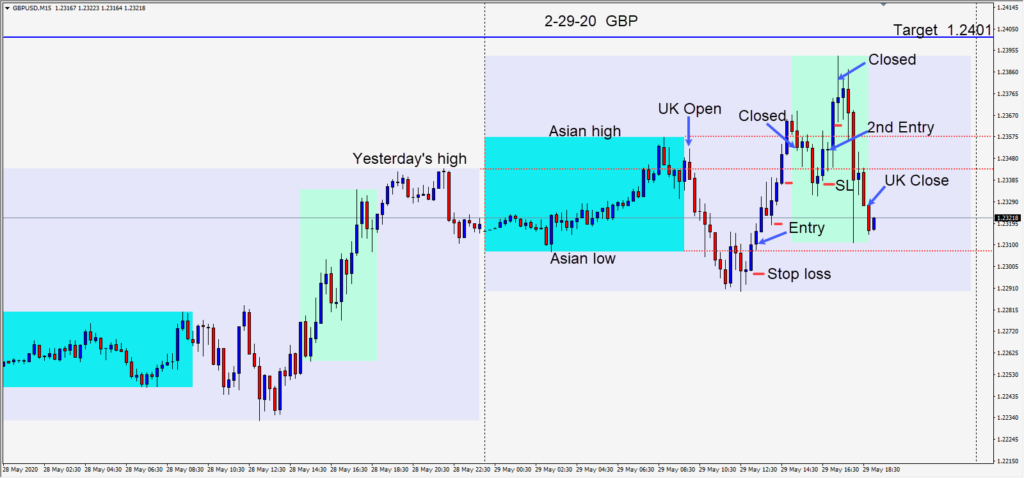

Today a long was taken in the GBPUSD as it began to climb off its session lows – risking 19 pips for a potential 85 pips to our daily target at 1.2401. Price moved higher but failed to stay above its Asian high so we exited the first trade.

As price began another move higher we entered again… risking 15 pips for a potential 49 pips to our target. As price moved higher it failed to reach the 1.2400 figure and we quickly exited.

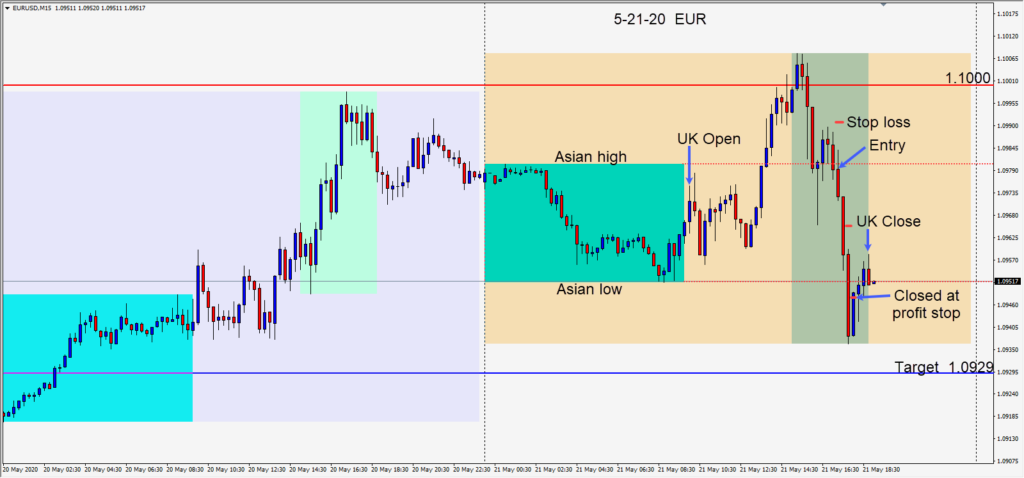

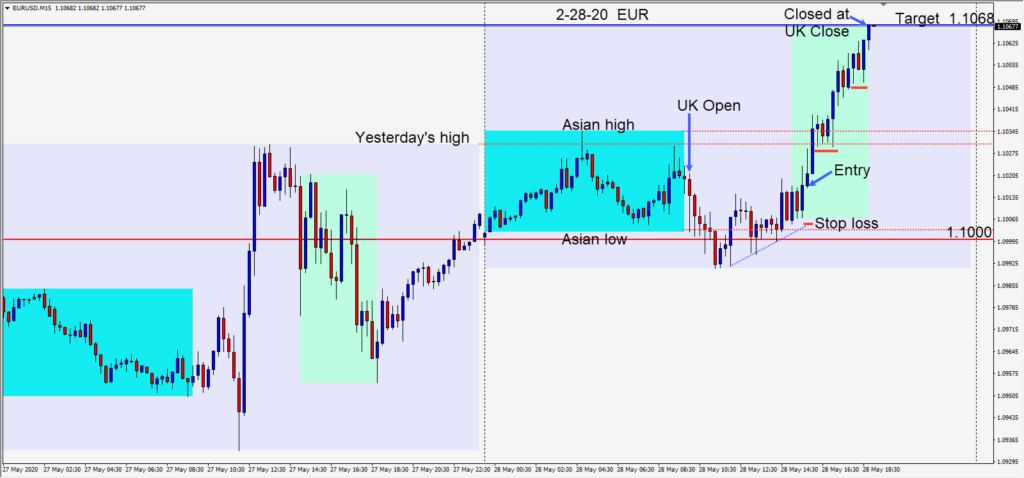

Yesterday was a similar day of USD weakness. After the EURUSD had made a series of higher lows and was comfortably above the critical 1.1000 figure, a long was taken risking 14 pips for a potential 51 pips to our daily target at 1.1068.

Price climbed steadily higher during the U.S. session overlap and we exited the trade at the U.K. close as it reached our target.

I’m not convinced that the “risk on” trade sentiment is going to last, but this week the stock markets benefitted. There has been a lot of negative talk directed at China from President Trump and we will soon know whether this is just empty political talk or if he means business.

Overall, it was a very negative week for the USD as the month of May concludes.

Enjoy your weekend and good luck with your trading!