The markets have not produced a lot of great trade setups to my eyes of late.

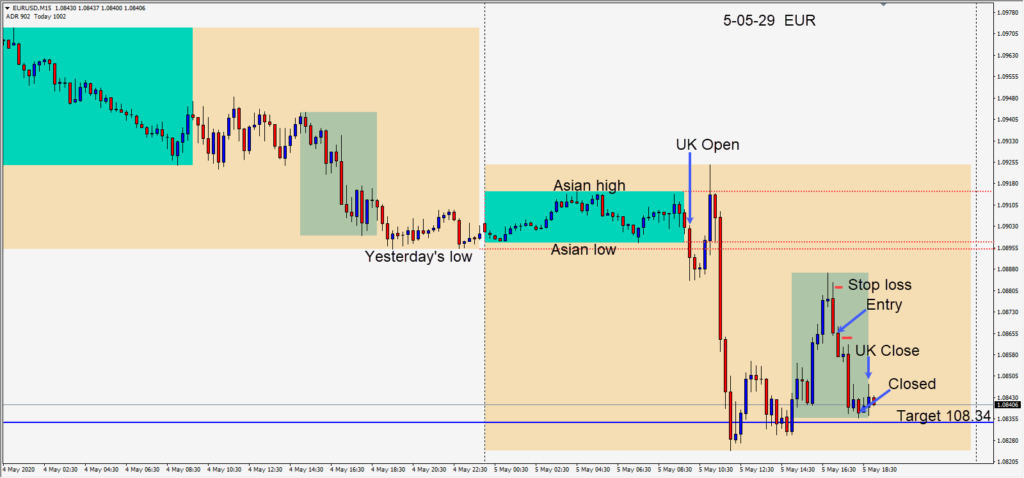

The EURUSD made an abrupt move down today after Germany’s top court ruling – going through our daily target at 1.0834. It then made a retracement upward before completing a reversal pattern in the U.S. session overlap.

An entry was taken short risking 15 pips for a potential 30 pips to our daily target. As price had already reached our target earlier, and time left in the U.K. session was dwindling, we closed the trade a couple of pips above our target to be on the safe side.

As clear as this setup appeared, I wasn’t prepared to place a stop loss above market structure and take a less than 2:1 reward for the risk on the trade.

There have been a number of smaller sized trades that add up, but not many large moves that didn’t require uncomfortably large stop losses for me over the past week.

My bias is currently is to be long the USD and trade both the EURUSD and GBPUSD short. The EURUSD looks like it may test 1.0800 and a break of the figure will likely have it test 25 pip increments down to 1.0700 in the near term… as long as the USD can rally.

Trading is tricky and requires patience as we navigate our way through this coronavirus period.

Good luck with your trading and stay healthy!