The markets have a lot to be concerned about going into the weekend. Foremost, the continued coronavirus (Covid 19) effect to the world economies. Add to that U.S. China trade relations are deteriorating once again, bringing into question whether Phase One will be scrapped altogether and China’s pending response if that happens. Britain and the E.U. are far from agreeing on the terms of Brexit, and so far Britain does not want an extension. This week the GBP has been on its back foot…which makes the EURGBP quite tradeable when the EURUSD and GBPUSD diverge.

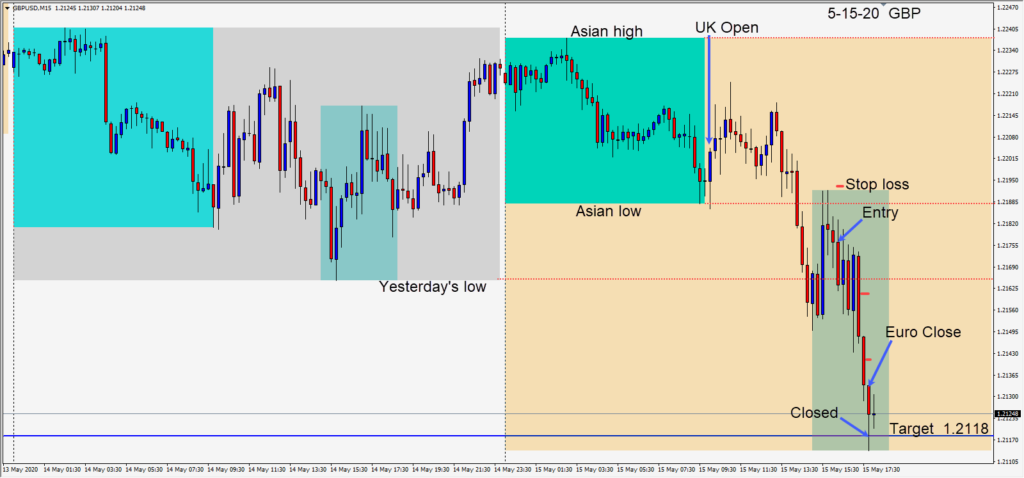

Today after the GBPUSD double topped early in the U.S. session, a short was taken risking 17 pips for a potential 58 pips to our daily target at 1.2118.

Price was already beneath its Asian session low and began to move down to test yesterday’s low. Once it closed beneath that, it descended quickly to our daily target where we exited just before the European close.

The break of the GBPUSD beneath the 1.2250 level was significant this week. A move toward 1.2000 now is probable. This level will likely hold at first test. Whether buyers will jump in at 1.2100 or 1.2050 and get control will soon be known. I will continue to look for short setups coupled with USD strength.

Enjoy your weekend, stay healthy and good luck with your trading!