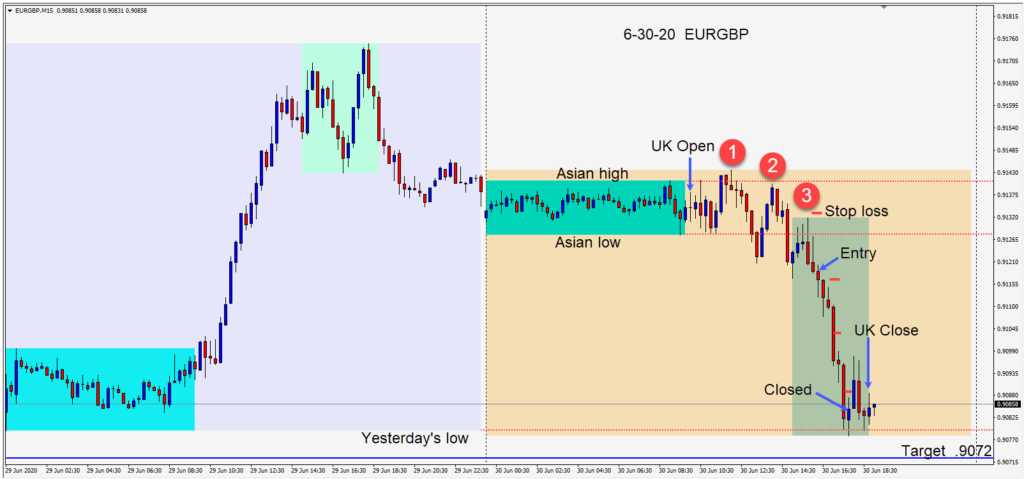

Month end tends to be volatile with exaggerated moves in either direction often appearing to be quite random.

Although the EURGBP has been trending upward, the Euro was looking weak today and it was Sterling that was looking strong.

A short was taken after the pair made a third lower high in the session requiring a 15 pip stop loss for a potential 46 pips to our daily target at .9072. As price moved lower we removed the risk from the trade by moving our stop loss to a profitable position.

Price continued lower to test yesterday’s low – a level which was also a technically significant level on the hourly chart. We closed the trade on the bounce at the European close.

Trades in the USDCAD and GBPUSD were also very tradeable today.

The coronavirus remains very prevalent in the U.S. Some states that had been reopening are already shutting certain areas back down as the infection rates had begun to soar.

Tensions between the U.S. and China are picking up again as the preferential treatment of Hong Kong is suspended due to the new National Security Law introduced by China today.

Good luck with your trading in the second half of the year!