In June, Federal Reserve Chairman Powell stated, “We’re not even thinking about thinking about raising rates.” Yesterday he didn’t make any new quotable remarks. It appears that the Fed will be on hold for a very long time and the equity markets like it… and the USD moved lower.

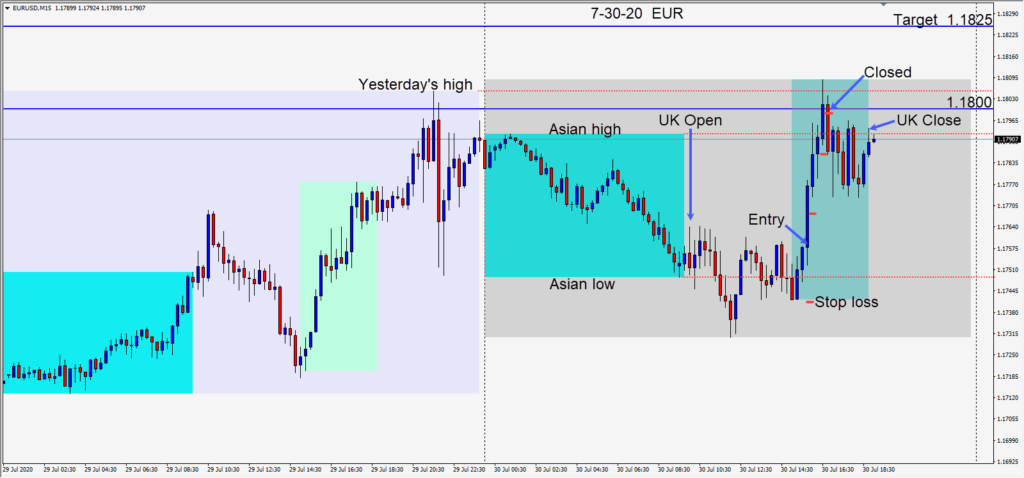

Today after the U.S. economic news releases, a EURUSD long was taken risking 18 pips for a potential 67 pips to our daily target at 1.1825. Euro bulls are eyeing 1.2000 but above the 1.1800 figure met some selling today… and we closed the trade as it moved beneath.

Some heavyweight companies are reporting earnings today and this may lead the market tomorrow.

Interestingly the USD had moved upward today but couldn’t hold its gains and dropped yet again. Did the brief move higher suggest buyers are beginning to take long positions? At a certain point, the market which is extremely long the Euro will reverse course.

Equities will be entering their challenging months of August and September which historically have not been good ones since 1950.

With the exception of Roger Babson, I am not aware of anyone who can predict where the markets will be in the future with any accuracy. These are interesting times we live in and it’s highly unusual for the U.S. economy to have contracted to this extent and for the Euro area to outpace it.

Friday looks like it may be active as we end the month.

Good luck with your trading and stay healthy!