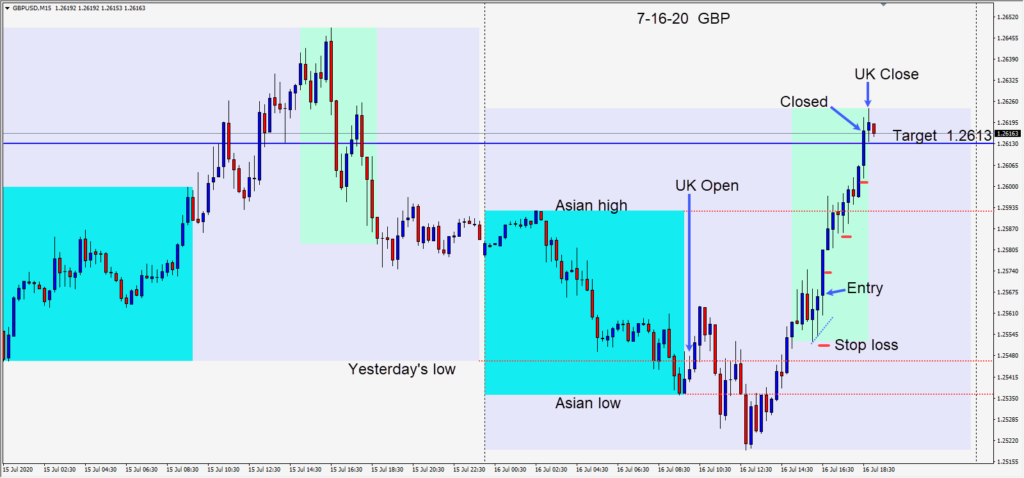

On a day when global equity markets were lower, the GBPUSD managed to move higher. The pair had momentum going into the U.S. session overlap and as it pushed higher a long was taken risking 16 pips for a potential 47 pips to our daily target at 1.2613.

Despite the USD showing signs of moving higher, this pair was able to steadily climb and surpass our target for a nice gain.

Trading has been slower lately for me. A EURUSD trade on Monday netted 27 pips and a mistimed long in the pair on Wednesday netted a loss of 12 pips.

Traders will be paying close attention to the European leaders’ summit this weekend for details on the European Recovery Fund. This could potentially move the EURUSD above 1.1500 in the coming week.

Continued USD weakness may manifest as new Covid 19 infections continue to surge in America. President Trump has been losing ground in the polls and the Republicans’ Senate majority is also at risk. As we approach the end of July, the question remains as to whether Congress and the White House can agree on a fresh fiscal stimulus.

The USDX did not take out June’s low which is USD bullish… as the March low was beginning to come into focus.

Friday trading is usually fun…

Good luck with your trading!