The market is long the Euro and short the USD leading up to the FOMC meeting minutes today. Without Congress agreeing on a stimulus package there is little reason to be USD bullish at the moment. The trade agreement between the U.S. and China is in question again and President Trump’s reelection is also in question.

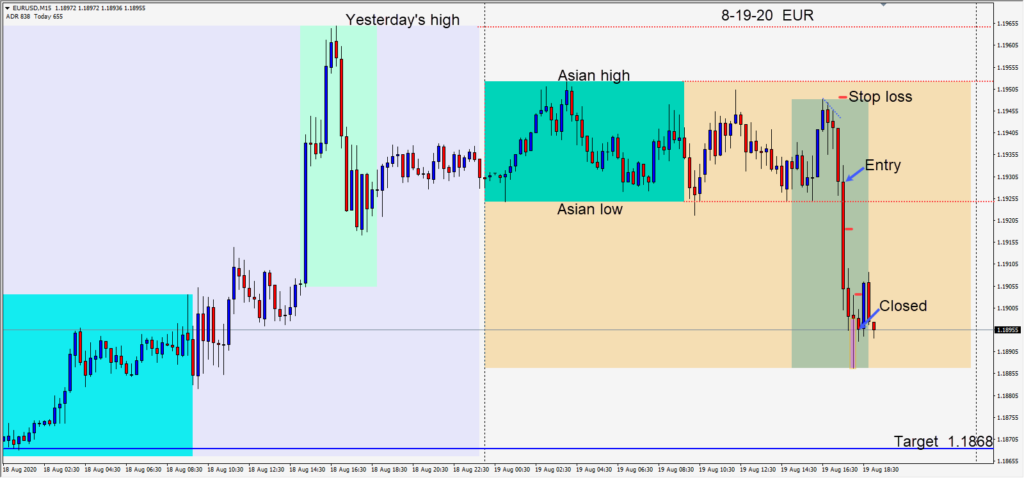

The EURUSD made three lower highs today as it tried to climb toward the large 1.2000 psychological number. After three candles in the U.S. session made lower highs, a short was taken risking 20 pips for a potential 61 pips to our daily target at 1.1868.

Price dropped taking out its Asian session low and the 1.1900 figure. Just above 1.1885 buyers began to enter and we closed the trade well in advance of the Fed.

The question for euro longs will be whether the pair can close above 1.1900 for the day and move up toward 1.2000 tomorrow or if a move lower to 1.1850/1.1800 area is the next support.

When the majority of the market is weighted in one direction, a move in the opposite direction can create a trading frenzy, as profits begin to erode quickly and a vertical move can follow.

The month has been a slow grind overall which is not uncommon in August. Equity markets continue to make new highs which is uncommon in the summer.

Good luck with your trading and stay healthy!