The major event risk this week was the ECB monetary policy statement and press conference that followed…particularly after their chief economist Lane’s statement last week about the exchange rate.

The acrimonious divorce between the E.U. and Britain has heated up with the U.K. reported to be willing to break international law. This is not good for the Sterling. The E.U. has responded by giving the U.K. until the end of the month to amend the legislation that would violate the Brexit withdrawal agreement. The U.K. reportedly has released a legal opinion that said parliament has the power to pass laws that are in breach of treaty obligations. This is getting getting very interesting! Markets don’t like uncertainty and even Nancy Pelosi is said to be scolding the U.K. on their current stance.

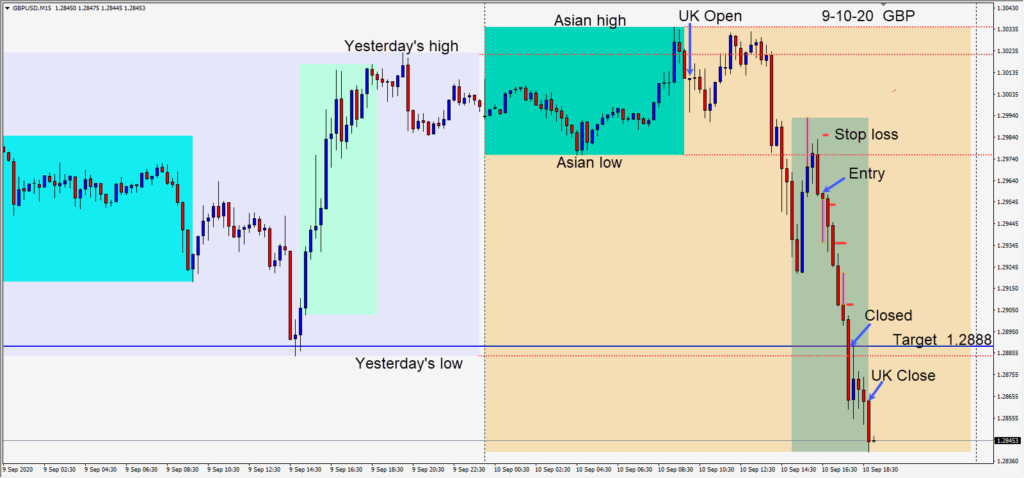

Today a short was taken in the GBPUSD risking 27 pips for a potential 69 pips to our daily target at 1.2888. This pair has been very active lately due to Brexit headlines.

Price moved lower, and we took the risk out of the trade moving our profit stop lower protecting our gains and exited the trade at our target. Price had managed to push through the 1.2900 figure and we continued to lock in profit as buyers could have entered at this level. With yesterday’s low a couple of pips away (potential further support), we were happy to reach our target and exit. Price continued lower but retested our target before dropping further going into the London close.

I’m not concerned about the pips I don’t get in a trade. I concentrate on getting the risk out of a trade, so that the trade’s outcome is positive if the market reverses. Locking in pips as the trade moves toward the target is of paramount importance to me. When the worst case scenario is that your trade is going to have a positive profitable outcome, it’s a lot easier to be objective and read what the market is telling us.

Friday has a fairly light economic news calendar but keep an eye on U.S. Core CPI for market reaction.

Good luck with your trading!