The USD continued to attract more bears than bulls this summer during July/August and this was especially notable in the EURUSD move. In August the pair tried twice to close above 1.2000 but failed. The GBPUSD has also moved up and the Sterling bulls continue to anticipate a close above 1.3500.

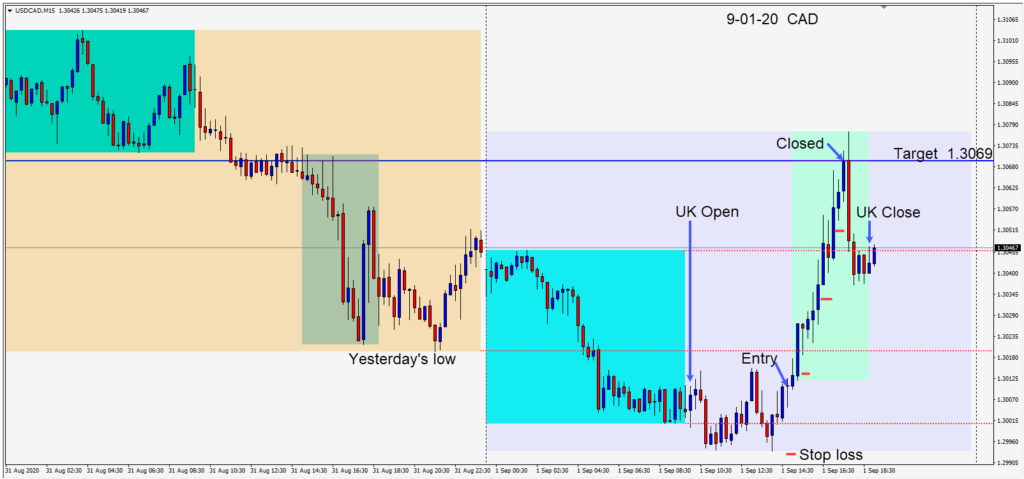

Fresh back from vacation this week, and to start the month of September, my attention was on the USDCAD which was finding buyers near the 1.3000 figure as it tried to push lower in advance of the U.S. session.

A long was taken risking 18 pips for a potential 59 pips to our daily target at 1.3069 as price moved off its lows of the day to stay above 1.3000.

As price began to move higher, we removed the risk from the trade by locking in profit in advance of the U.S. economic news releases. The better than expected ISM Manufacturing PMI helped the USD move higher.

September has arrived and we are just over a couple of months away from the U.S. election on November 3rd. The market volumes will pick up as traders begin to return from summer holidays. The Nonfarm Payroll release will be out on Friday and next Monday will be a holiday in North America.

Keep an eye on the big numbers for clues to USD strength and weakness.

Good luck with your trading!