Trading on Tuesday was rather subdued but with all the Brexit news lately my bias is to look for short GBPUSD setups while this pair is very active.

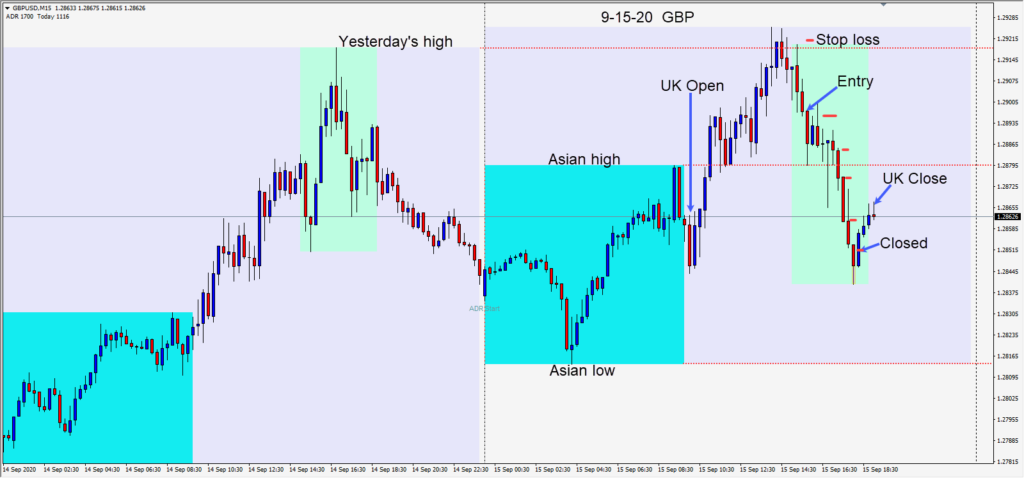

A short was taken today risking 24 pips for a potential 142 pips to our daily target at 1.2755.

After the U.S. economic news, a short was taken as the pair rejected the 1.2900 figure. As price moved lower, we protected our profit and the trade was eventually closed at 1.2850 as it began to retrace after the European close.

The European close has been very notable this year and it’s not uncommon to see an exaggerated move in the last 15 minutes of the session.

Wednesday the market will be focused on the Federal Reserve and is anticipating a dovish outlook and possible clarity on what “flexible average inflation targeting” means. The Fed is concerned about how to stimulate the economy to reduce unemployment and also to attain inflation in the 2 percent range.

The Fed’s strategy will be revealed and keeping interest rates low for the foreseeable future may serve to support equity performance further. With virus levels on the rise in Europe the USD may get a boost, but we will wait and see how the market reacts to Chair Powell’s latest revelations.

Good luck with your trading!