For a second day this week, the USD has been bid and moved significantly higher versus the majors. We haven’t moved out of the recent range entirely but a close above 94.00 would be bullish.

It appears traders are becoming concerned about the increasing new virus infections in parts of Europe and Britain. The U.S. economy appears to be strengthening while the virus infection rate is currently in decline.

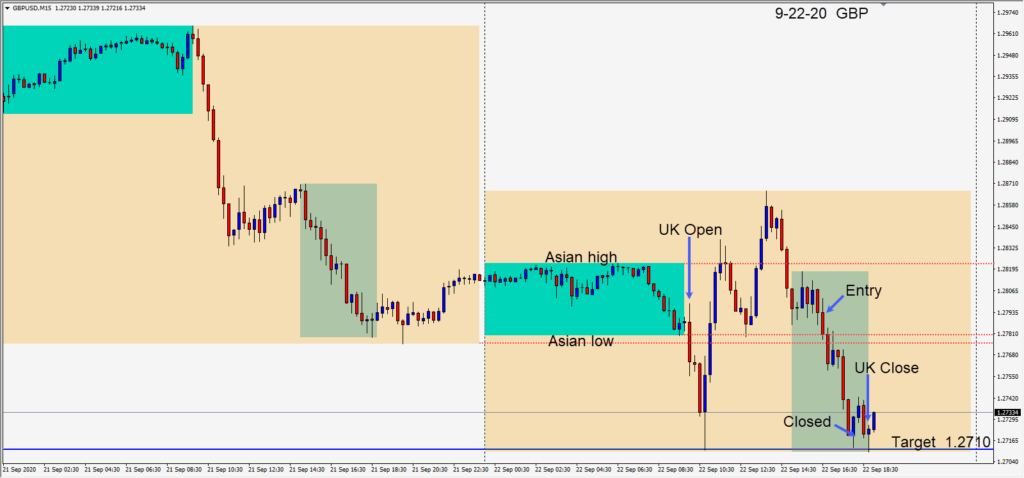

Today as the dollar strengthened further, a short was taken in the GBPUSD as it began to move lower during the U.S. session overlap – risking 25 pips for a potential 82 pips to our daily target at 1.2710. Price fell through its Asian session low and continued lower before stalling its descent at 2 significant levels from the daily chart just above our daily target.

Tomorrow the Japanese traders will return from holidays and the BoJ Monetary Statement will be released. Fed Chair Powell will be testifying again and will likely reiterate his concerns for the U.S. economy as long as the virus continues to affect it. As the election nears both parties are stepping up the anti-China rhetoric in an attempt to win voter support.

Good luck with your trading!