A light news day and a very heavy USD which continued its downward trend to close the trading week.

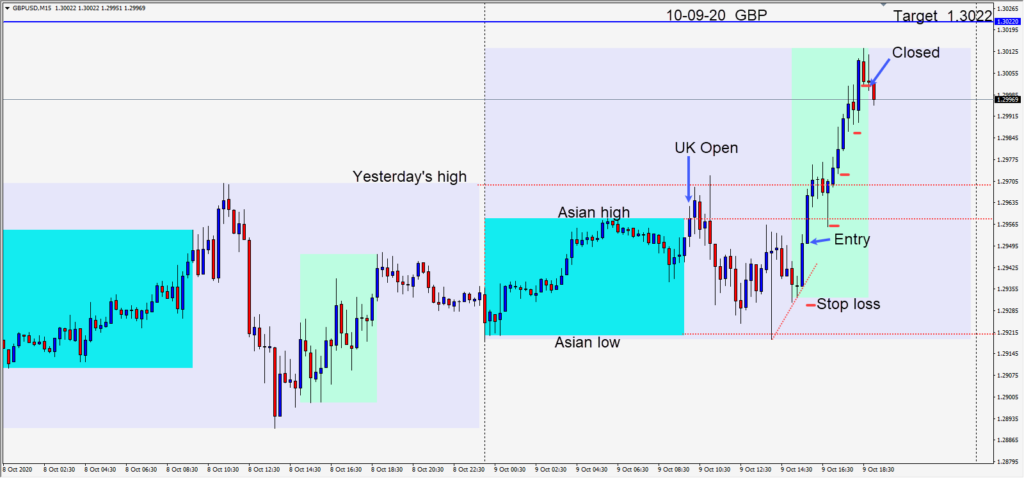

The GBPUSD remains the most active pair of the majors. Today early in the U.S. session overlap, a long was taken risking 20 pips for a potential 72 pips to our daily target at 1.3022.

Price moved strongly higher as the USD moved lower. A slight pullback closed our trade just before the U.K. close.

The majors offered several good trade setups today and my favourite was the GBPUSD due to its potential to move further than the other pairs with its current range.

Fridays tend to be good days to trade with the exception being the non-farm payroll ones.

It’s been a rollercoaster ride of late as the market adjusts to the perceived U.S. election outcome and the resurgence of coronavirus infections in parts of Europe and the U.K. Brexit continues to be an unknown and drags on, as does a further stimulus package in the U.S. before the election.

Patience is always required in trading and waiting for high probability trade setups often involves hours of being on the sidelines. Many of my trades lately have had under 20 pip outcomes – as the market gyrates back and forth.

Although my bias tends to be USD bullish, the current market is looking quite bearish for the dollar. This can change abruptly on any given day/week, so it’s best to remain objective and trade technically what you see… and not have any strong convictions. Trading can be very humbling for those that prognosticate.

Monday is a holiday for many in North America.

Enjoy your (long) weekend, stay healthy and good luck with your trading!