Traders are struggling with USD strength and weakness. The equity markets are rising one day over optimism for a Covid 19 vaccine then falling the next over concerns about the rising number of new infections, closures, new restrictions and the potential impact on the economy.

Both ECB President Lagarde and Fed Chair Powell have both reiterated concerns this week about how long it may take before their economies may recover. Britain has not yet been able to come to a formal Brexit deal with the E.U. but the market seems to think that a deal will be made by year-end so the GBPUSD has been moving higher this week.

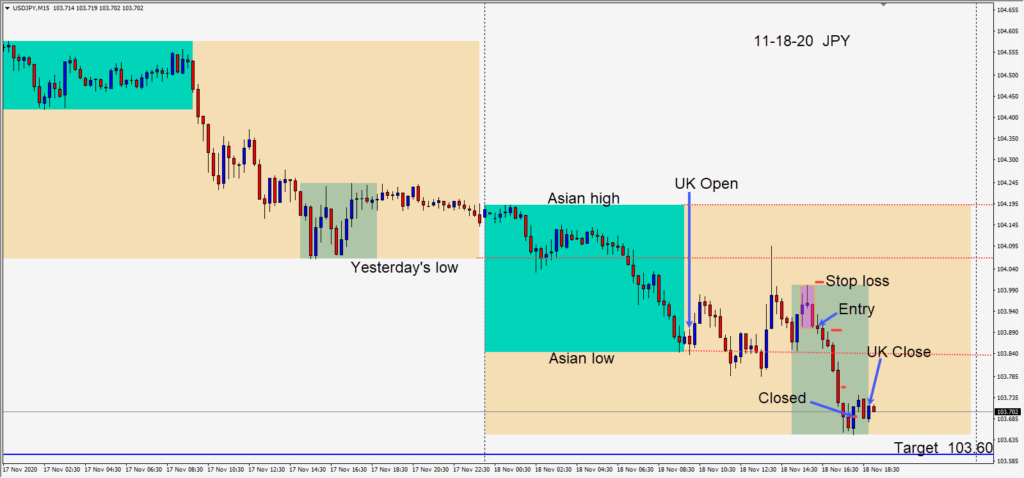

Today, early in the U.S. session overlap a short was taken in the USDJPY risking 11 pips for a potential 30 pips to our daily target at 103.60.

Price formed a reversal pattern and moved lower through its Asian session low, but stalled a few pips ahead of our daily target at 103.60. Our trade was closed for a modest gain.

The recent break below 104.00 in the USDJPY opens the door for bears to test the October’s lows in the 103.20 area. Bulls will want to get back above the 104.00 figure.

The EURUSD continues to oscillate between 1.1600 and 1.1900. Currently a break below 1.1725 would be bearish and a break above 1.1920 would be bullish.

Good luck with your trading and stay healthy!