Last week was the slowest and most boring trading that I have seen in a long time. It appeared that a lot of institutional money remained on the sidelines awaiting confirmation of direction. The USDJPY was my favourite pair to trade last week but it’s moves were minimal.

On Monday to begin this week, we had for a third Monday in a row optimistic vaccine news, this time from AstraZenica.

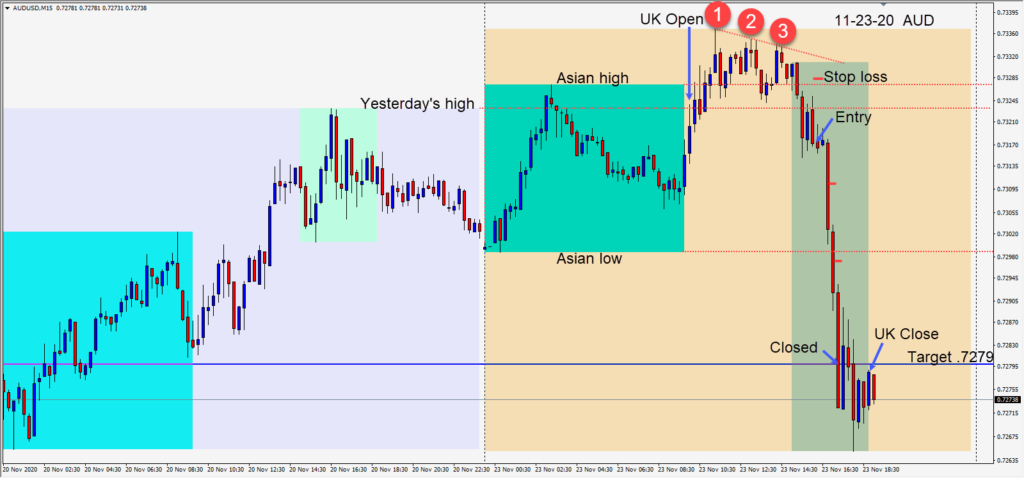

The USD moved higher on the day and a short was taken in the AUDUSD risking 15 pips for a potential 37 pips to our daily target at .7279.

The pair had made a series of lower highs and the strong USD led us into our short trade. It was the surprisingly high U.S. PMI numbers that jolted the market and the majors began to take off.

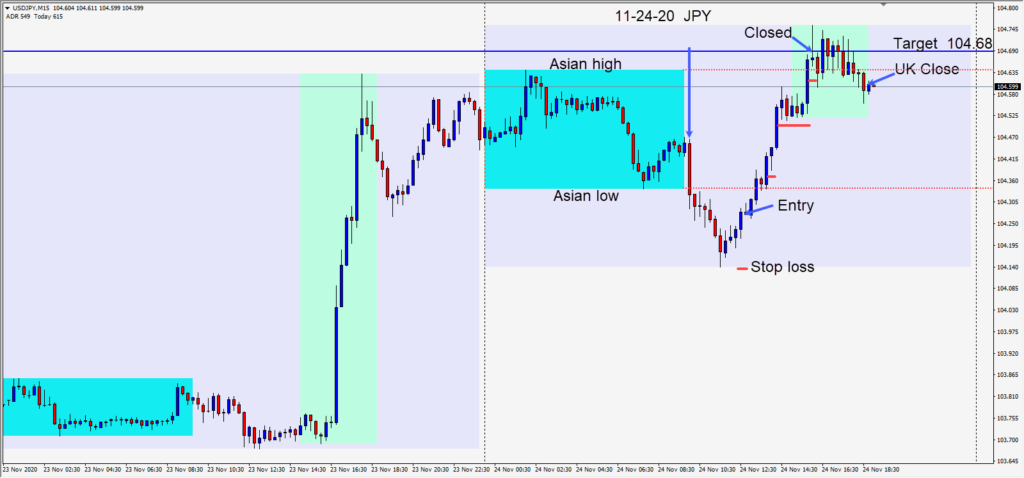

Today the risk-on sentiment continued for a second day. Our first trade was the USDJPY long… risking 15 pips for a potential 41 pips to our daily target at 104.68.

Price had moved lower after the U.K. open and found a bottom. We waited to be convinced that the move higher was worth the risk. Price moved higher retracing its entire move lower for the day and reached our target early in the U.S. session overlap where we exited.

As the S&P 500 Futures pointed to a .75% jump at the open today coupled with a move higher in oil, we went short the USDCAD risking 15 pips for a potential 53 pips to our daily target at 1.3016.

Price dropped to its Asian session low where we gave it room to retest this level. As the pair moved lower, long lower wicks began to form under the candle bodies and we tightened up our profit stop. We closed the trade in advance of the U.K. close.

It would appear that President Trump is beginning to accept the election outcome and President-elect Biden is appointing former Fed Chair Janet Yellen to be at the helm of the U.S. Treasury Department.

The U.S. Thanksgiving holiday is on Thursday and Friday is likely to be very light on volume.

Good luck with your trading!