The last month of the trading year is here. We believe we know who won the U.S. election but still await President-elect Biden’s certification.

What we don’t know for sure is when Brexit will be resolved (hopefully by year end) and how the new President of the United States will handle the tense relationship with tariffs and China. We await the U.S. Stimulus Package as politicians continue to bicker on this side of the Atlantic as they do on the other side of the Atlantic.

What is notable is the DXY broke down through 92.00 and is now down testing 91.00. The EURUSD broke above 1.2000 and has now tested 1.2100. The GBPUSD is producing some very large moves in single candles at odd times of the day both yesterday and today. An eventual Brexit deal could either pop the GBPUSD to test 1.3500 or be a case of ” buy the rumour, sell the news” and we see it fade?

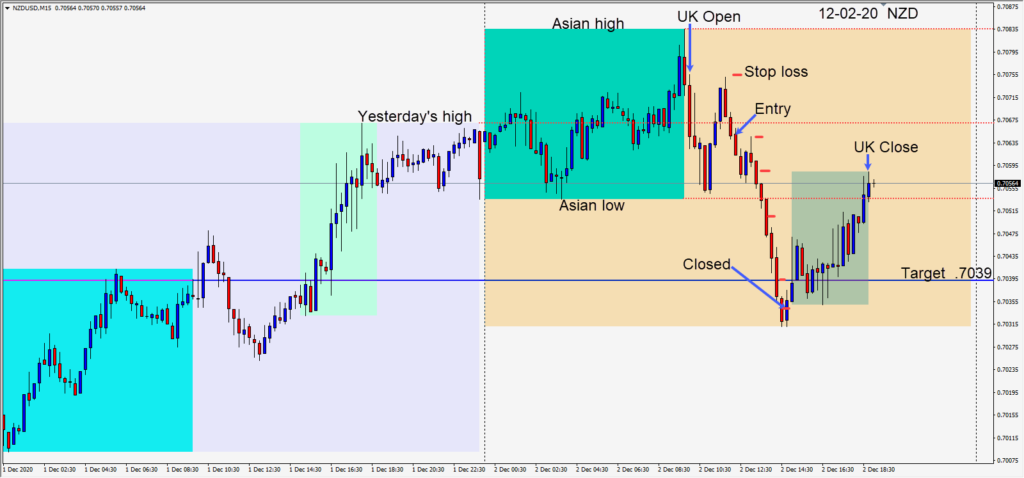

Today, a short setup was found in the NZDUSD risking 11 pips for a potential 25 pips to our daily target at .7039.

Although this is a countertrend trade, it had downside momentum as it moved to test its Asian session low. When it broke through this level the momentum continued past our target which we quickly protected. We then managed to capture a few more pips before a retracement began going into the U.S. session.

Trading has been slower than usual and the GBPUSD action has been quite erratic. Certainly the last few days of November made for volatile trading.

We have a couple more weeks of trading before things slow down for the holidays.

Trade carefully and be disciplined.

Good luck!